Vitamins, Minerals and Supplements in the Middle East and Africa

Key trends and considerations for VMS brands looking to target MENA

The global vitamins, minerals and supplements (VMS) market has experienced somewhat of a surge in light of the Coronavirus pandemic. With changing consumer attitudes towards health and wellness, it’s one very lucrative business.

One region that many producers of VMS products often overlook is the Middle East and North Africa (MENA), however it presents several opportunities for brands who are willing to go the extra mile to get ahead of the competition.

In this article, we’ll present a snapshot of the VMS market landscape in MENA, summarise six popular product categories, and wrap up with some key considerations for entering the region based on our experiences. So, let’s jump right in.

The Vitamins, Minerals and Supplements Market Landscape in MENA

According to 2021 data from UNICEF, 20 countries make up the Middle East and North Africa region, although this number does vary depending on the source and is often extended to include countries in Western Africa too.

As of 2018 the combined population across MENA was 578 million, with an average growth rate of 1.56%.

In terms of the VMS market of MENA, there are five key segments: vitamins and minerals, fatty-acids, protein, probiotics, and other.

Over the last 12-months, key market drivers include increasing health consciousness amongst consumers, education and awareness of the benefits of preventative healthcare, rising aging populations, intolerances and other ailments such as diabetes, all of which have contributed to a vast number of the population choosing to adopt a heathier lifestyle.

In terms of market constraints, high price points and stringent regulations in certain countries have had a slightly negative impact on sales and brand growth.

Let’s look at some data to back this up. The wellness supplements market of the MENA region is anticipated to reach 16.61 billion USD by the end of 2021. And, thanks to an estimated CAGR of 6.24%, will reach 22.49 billion USD over the next five years.

As mentioned above, because of consumers’ willingness to add VMS products into their daily lives, through increased self-medication, the region offers several opportunities for international brands looking to enter the market. This is also helped thanks to expanding distribution networks across the region and an increasing number of chemists and pharmacies, making it easier for new brands to reach potential customers.

Market Entry for VMS Brands

Unlike in Europe and North America, vitamins, minerals and supplements are often purchased directly from chemists and pharmacies, or via a doctor’s prescription.

For brands targeting MENA, this often means reformulating their market strategy and products – more on that later – but the good news is that both local manufacturers and consumers are embracing innovation and new formats.

As you can imagine, the biggest players in the MENA VMS market are mostly recognisable names. See the list on the right. That being said, there are also plenty of smaller brands which do incredibly well in their home market. For example, in Saudi Arabia local manufacturers are favoured, and therefore local pharmacy chains Tabuk, SPIMACO, and Jamjoum now produce their own products.

This also opens up opportunities for private label solutions for international brands looking to enter the region.

Price is another important factor for VMS brands looking to reach the MENA region. There has been a trend towards more premium offerings in the VMS space, with consumers willing to pay that bit more for the good of their health.

However, brands also need to be aware of the poorer populations across the region who will be looking for something more affordable, particularly when it comes to immunity boosters, multivitamins, and fertility aids.

VMS Product Categories Presenting Opportunities across MENA

Weight management

Obesity and diabetes are particularly prevalent across the Middle East, which presents opportunities for weight management supplement brands to pedal their wares.

If we single out one country, in this case the United Arab Emirates (UAE), we see statistics such as:

Health experts have put this down to diet, lifestyle and lack of education when it comes to weight management. This means that the demand for weight loss supplements remains high.

In an interview with Gulf News[1], dietician Dr Safeek Ali was quoted as saying:

“Despite the economic crisis across the globe, the weight management market is still accelerating as the core targets of this market are the consumers for whom health and beauty is of higher importance than the cost. Such impulsive consumers are driving the growth of the market.

The market players are therefore formulating attractive advertisements and brand promotions to gear up their product revenues amongst the numerous other alternatives and substitutes that are available in the market.”

Something for international brands to consider if targeting the UAE.

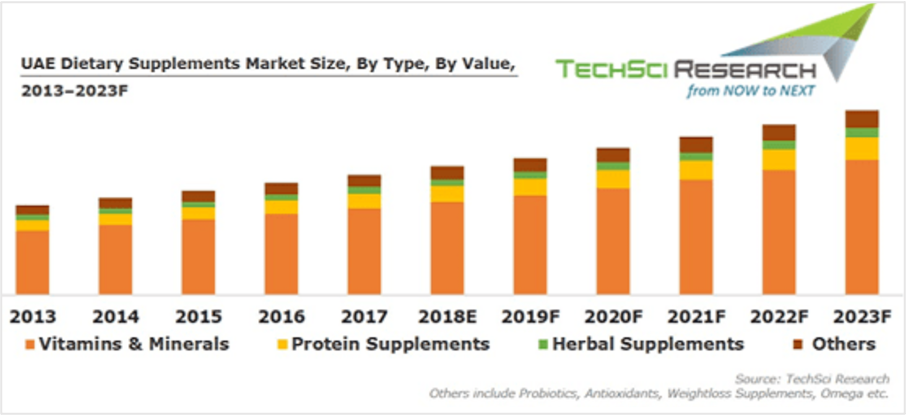

To put this all into context, the dietary supplements market of the UAE is forecasted to surpass 139 million USD by 2023.

Skin, hair and nails

Another area that is growing across MENA is “beauty from within”. Supplements that promote healthy skin, nails and hair will continue to do well in a couple of different ways.

Dermo-cosmetic skin essentials such as supplements for anti-aging, anti-cellulite and anti-acne will grow in more affluent regions, like the UAE, as well as supplements and other wellness products enhanced with collagen.

On the other hand, supplements to prevent hair loss and promote healthy hair and scalps will be in particular demand from both male consumers and Muslim women. Brands should bear this in mind when advertising their products in MENA.

Fertility aids

Across the MENA region, family is a huge part of local culture, particularly big families.

This prompts the need to source vitamins, minerals and supplements to aid with fertility, especially for women who look to get pregnant later in life.

Pre-natal and post-natal products are in demand across the Middle East and Africa. Price point is key here and must be considered by brands looking to enter the market.

Immunity boosters

It probably comes as no surprise that the Coronavirus pandemic has had a knock-on effect on sales of vitamins, minerals and supplements that boost immunity.

In Saudi Arabia, sales of Vitamin C products in 2020 grew substantially, with many consumers stockpiling products early in the pandemic to help ward off the virus and/or speed up recovery.

Other multivitamins and Vitamin D also performed well across the MENA region, and it is likely that taking these on a daily basis will become the norm for much of the population.

This is certainly the case for African markets as disease outbreaks are more common here, and consumers are gradually incorporating preventative healthcare measures into their lifestyles.

Probiotic supplements

Probiotic supplements have seen a slight decline in sales in MENA, however, it is expected that the category will recover thanks to new and innovative formats. For example, gummies and functional food products.

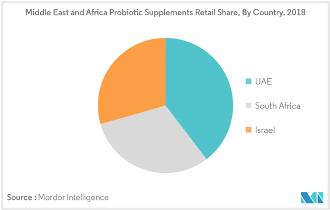

According to Mordor Intelligence, the UAE and South Africa are more likely to pick up on this trend. So, this is a factor for probiotic brands to think about when looking towards the MENA region.

The significant growth of probiotics in key markets is an indication of the growing supplement market across MENA.

Eye health

As a result of national and/or local lockdown measures during the pandemic, many of us spent far too much time staring at computer, television and mobile phone screens.

This was also the case in certain parts of MENA, like the UAE that has a high penetration of smartphones and electronic devices.

Of course, this has driven the need for VMS products that promote healthy eyes, reduce eye strain, and prevent myopia.

Eye health supplements, fish oils, omega fatty-acids, and other products containing lutein are becoming more popular across MENA, with several studies finding that consumers who take such supplements experience fewer dry eye symptoms than those who don’t.

Important Considerations for the MENA Region

The Bolst Global team have been helping VMS brands branch into the Middle East and Africa for a number of years. We therefore decided to pick the brains of some of our experts to help you understand the challenges you can face when entering particular countries. It’s important to understand that each region is different and needs to be treated so.

Here are eight factors to consider…

The final consideration when targeting the vitamins, minerals and supplements market of the Middle East and Africa, is not underestimating the need to find the right partners for your brand.

As we’ve seen, unlike European and North American markets, VMS products are often considered as being pharmaceutical goods. This means that you will have to find distributers who specialise in more medical channels in order to reach the right customers.

The MENA region is different to others, and you will have to go outside of your normal avenues and ways of working to identify local partners and routes to market.

The good news is the Bolst Global team can support you with this. We’ve helped several supplement brands branch into MENA over the years and have access to some great local networks across the region. So, if you’re in need of some assistance navigating the individual markets then get in touch today. We can’t wait to hear from you!

Sources:

https://www.unicef.org/infobycountry/northafrica.html

https://en.wikipedia.org/wiki/Demographics_of_the_Middle_East_and_North_Africa

https://www.marketdataforecast.com/market-reports/mea-wellness-supplements-market

https://www.euromonitor.com/vitamins-and-dietary-supplements-in-middle-east-and-africa/report

https://gulfnews.com/lifestyle/health-fitness/weight-loss-business-growing-at-fast-pace-1.733218

https://www.euromonitor.com/vitamins-in-saudi-arabia/report

https://www.mordorintelligence.com/industry-reports/middle-east-and-africa-dietary-supplement-market

https://www.euromonitor.com/dietary-supplements-in-the-united-arab-emirates/report