Health and Wellness in the Gulf

A Comparative Look at the UAE, Saudi Arabia and Kuwait

For years, UK food and beverage brands have been focused on exporting to mainland Europe but given the recent changes to this market it’s time to look further afield.

The Bolst Global team might be a little biased since we’ve spent a lot of time doing business in the Middle East and helping brands like yours to make a name for themselves in the health and wellness (H&W) market of the Gulf.

Three thriving markets in this part of the world are the United Arab Emirates, Saudi Arabia and Kuwait. Each have their own unique appeal, but also share a lot of similarities that you could maximise on depending on your offering.

In this comparative piece, we’ll take a look at the demographics of each country, the routes to market, and a deeper dive into some of the most lucrative product categories for international brands. Let’s get started.

Demographics

Located along the Persian Gulf, the United Arab Emirates (UAE), Saudi Arabia (KSA) and Kuwait can be found on the border between Europe and Asia.

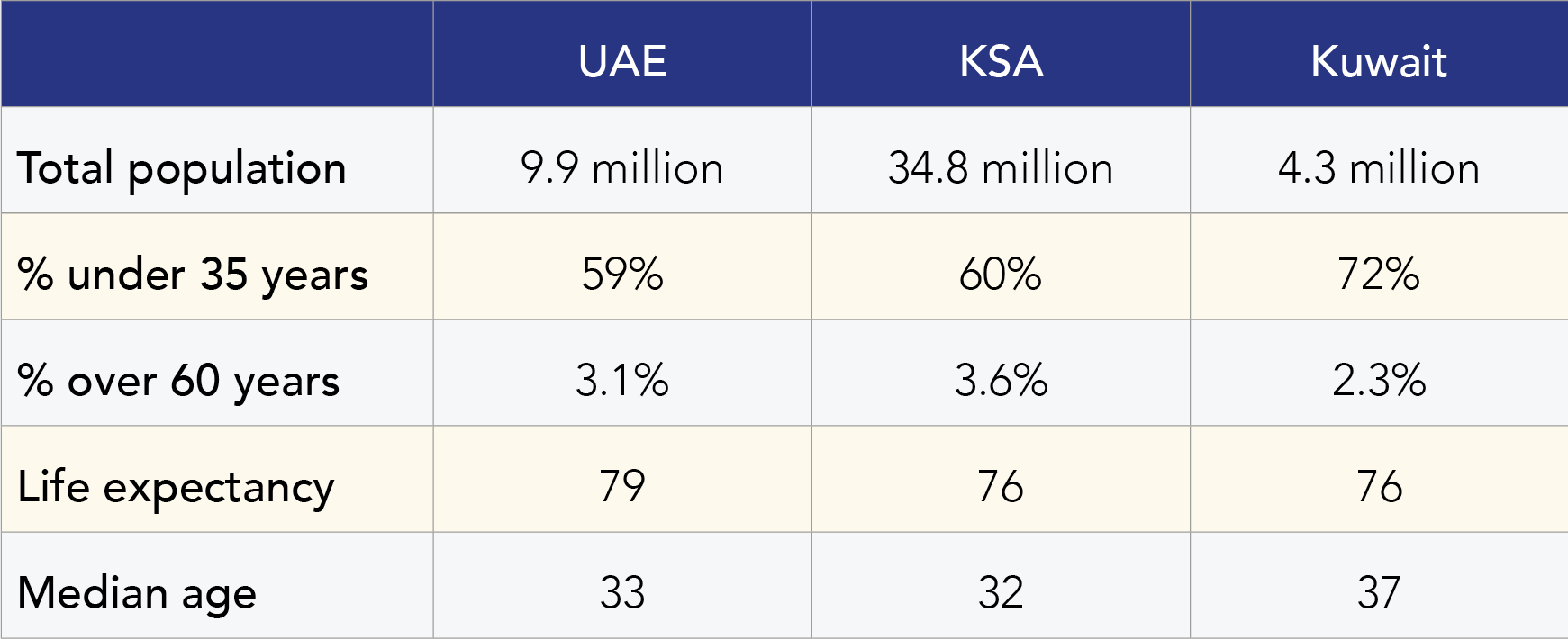

KSA is by far the largest country in the region with a total population of almost 35 million in 2020. In comparison, the population of Kuwait is one-twelfth of the size.

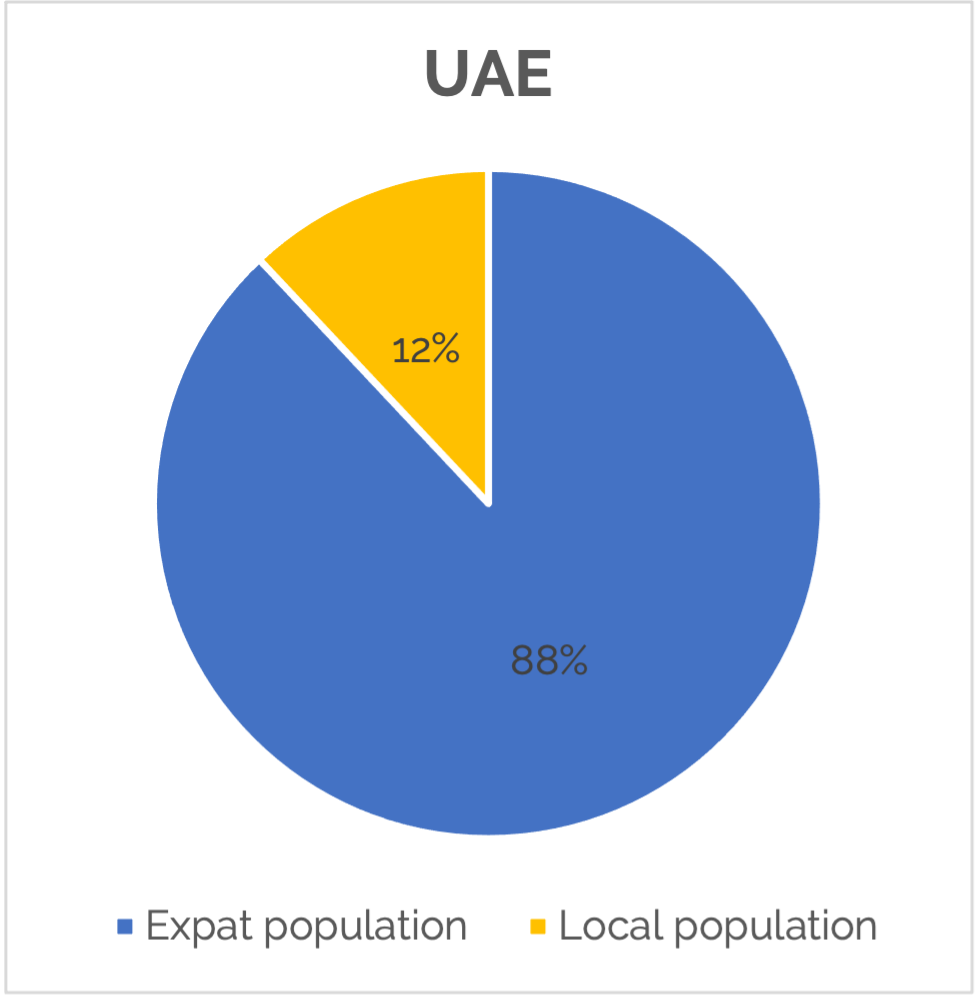

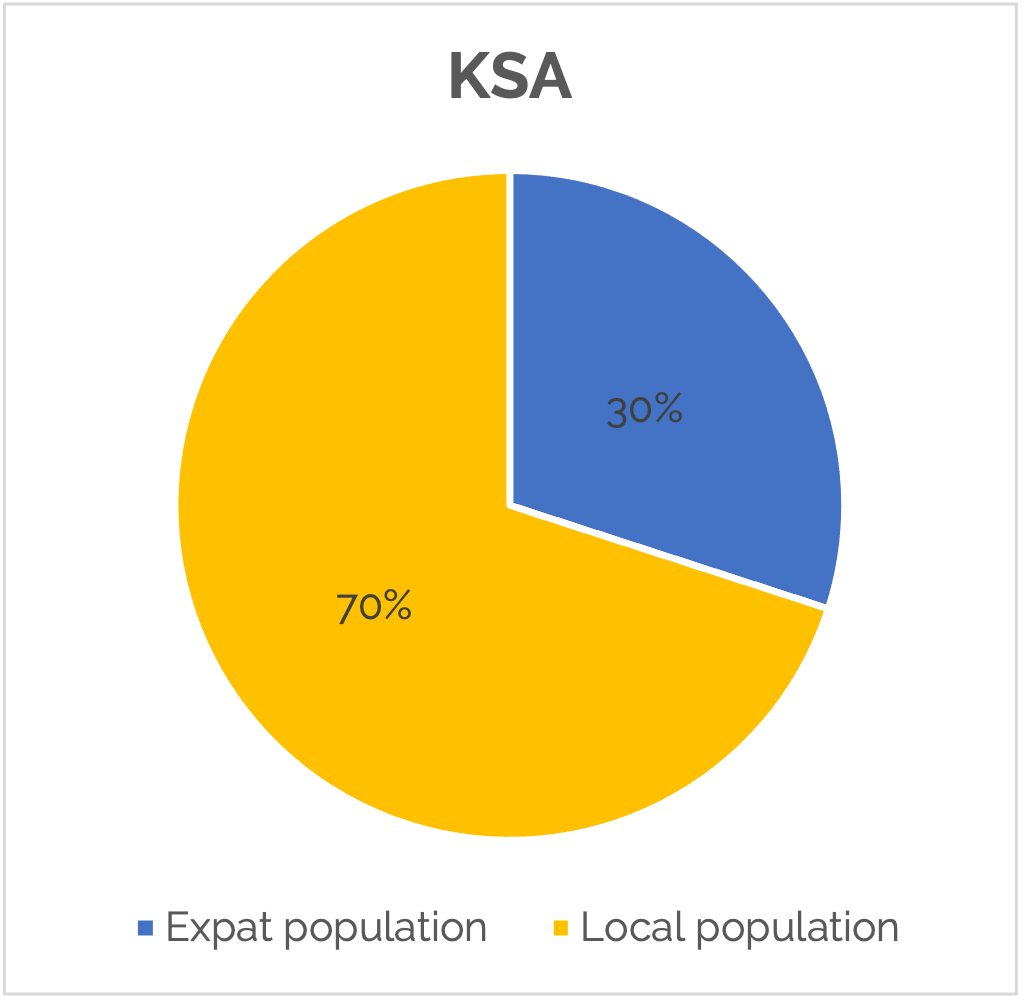

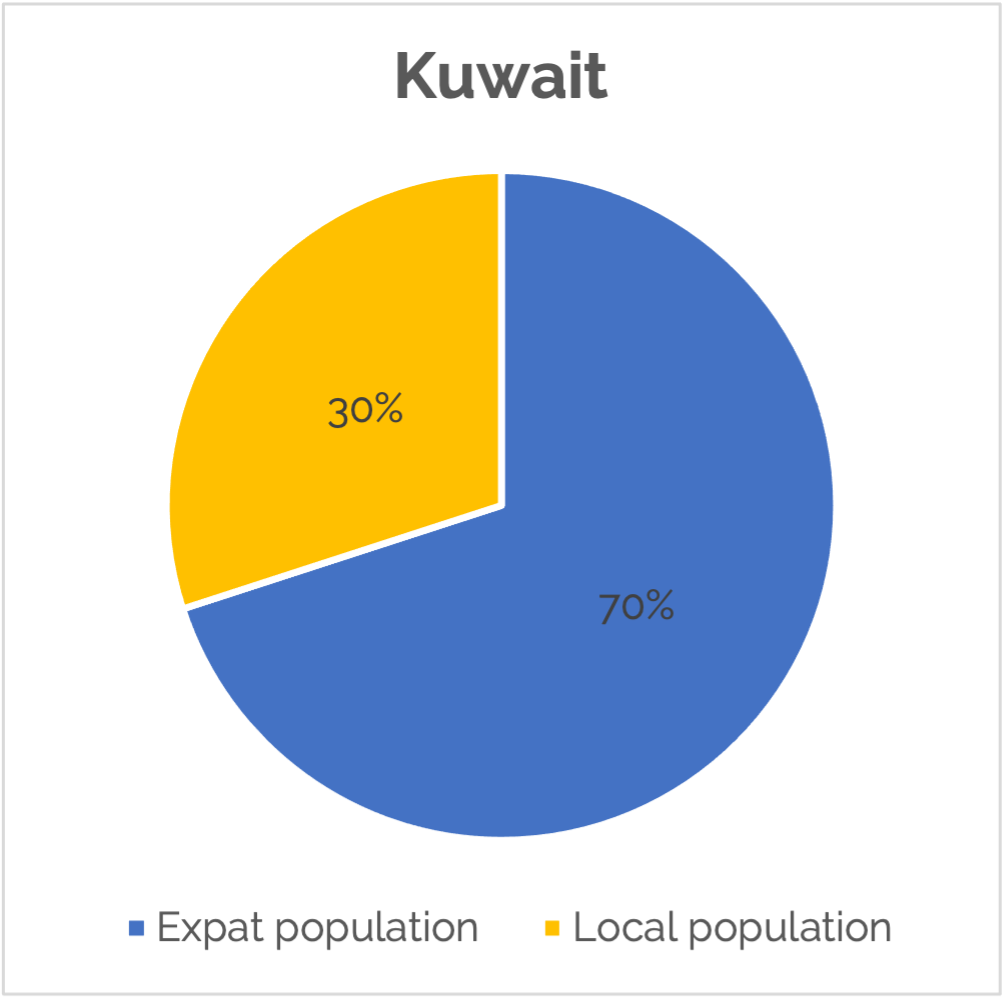

The populations of both the UAE and Kuwait have a high percentage of expatriates living in the countries, whilst the opposite is true for KSA.

What’s interesting about the region is the young population and workforce. The younger generations have very different buying habits to their parents and grandparents, with H&W incredibly important to the under 35s.

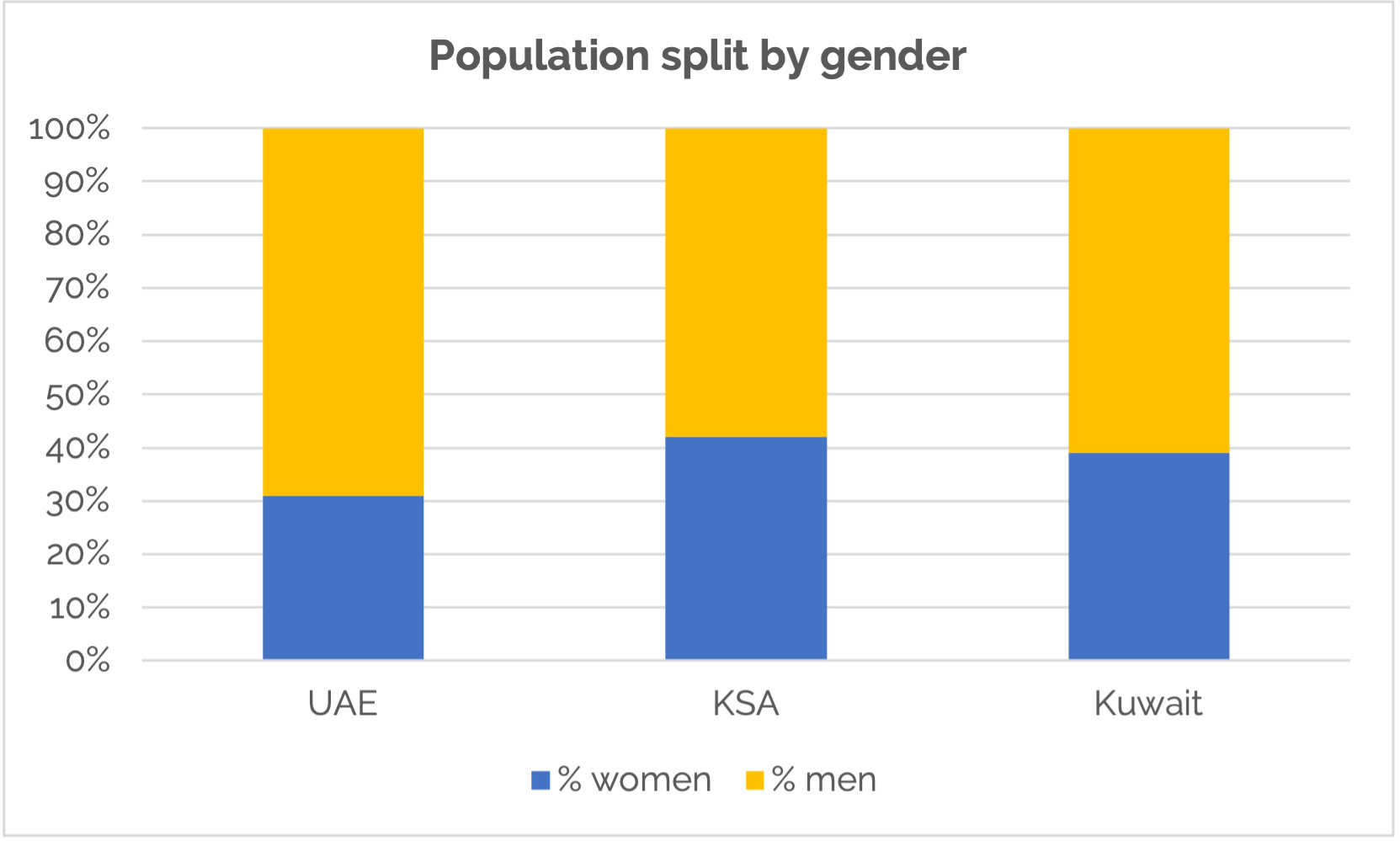

In recent years, we’ve seen some radical changes in terms of gender roles in the Gulf, seeing many young women entering the professional world. This is of particular importance for KSA since this demographic has their own disposable income for the very first time, and they’re looking to invest in H&W brands new to the area.

All three countries demonstrate high rates of diabetes, heart disease and obesity. Thanks to government initiatives, increased consumer awareness, and a desire to be fit and healthy, the H&W market is certainly on the rise in the region.

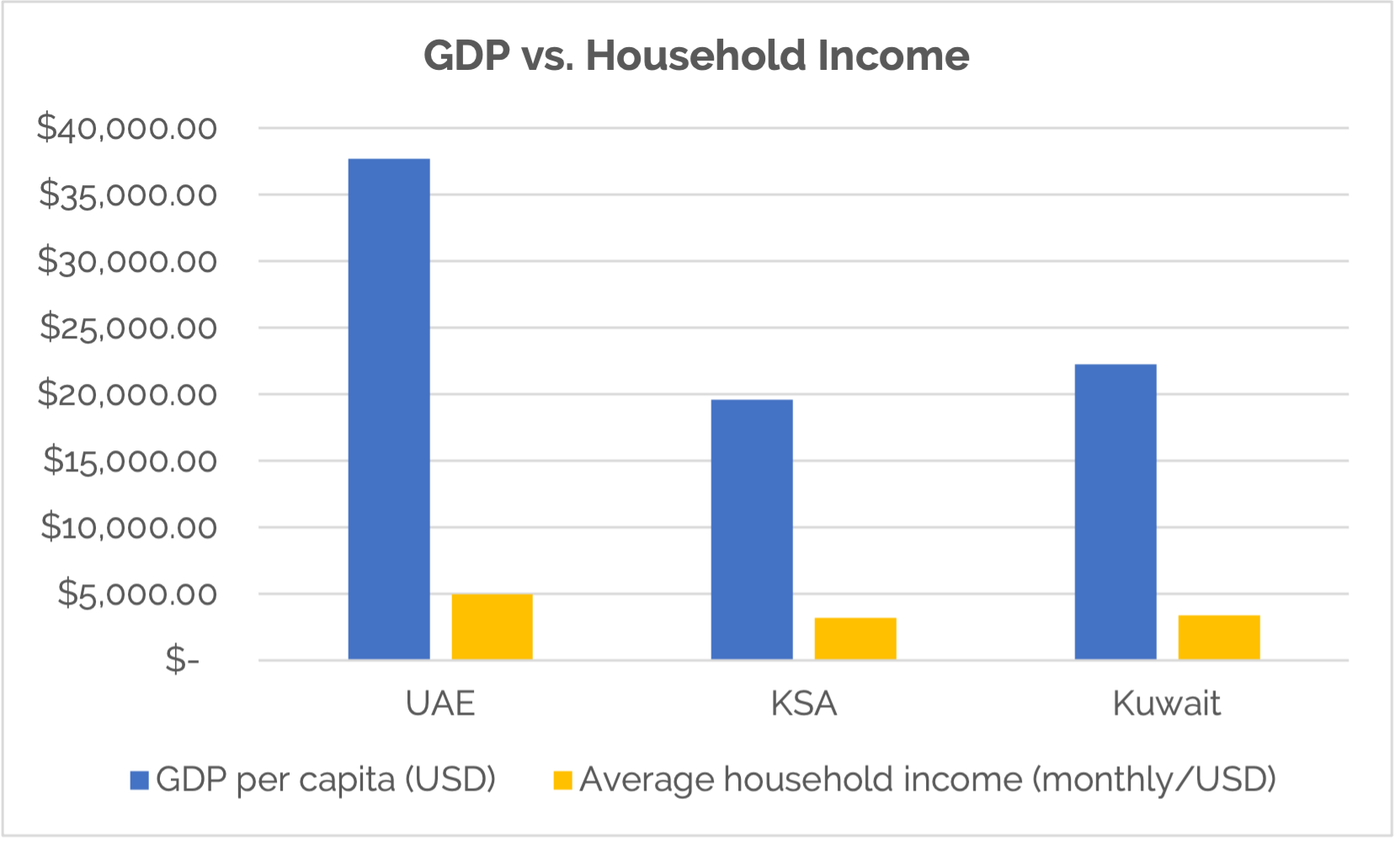

One common misconception of the Gulf is that, thanks to the oil trade, it is a wealthy part of the world. Although true in some respects, the average household incomes do not reflect this, particularly in KSA. This is something to bear in mind when pricing your products for the Middle East.

Routes to Market

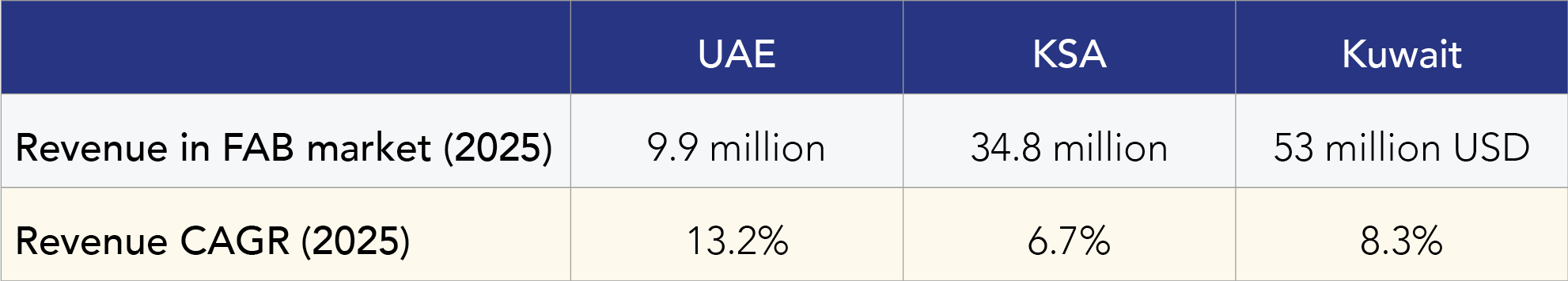

The food and beverage sector continues to grow year-on-year in the Gulf, with the following revenues forecasted by 2025.

With that in mind, finding the right route to market for your product is key, whether that be through a distributor or direct to retail, there are certainly a few things to consider.

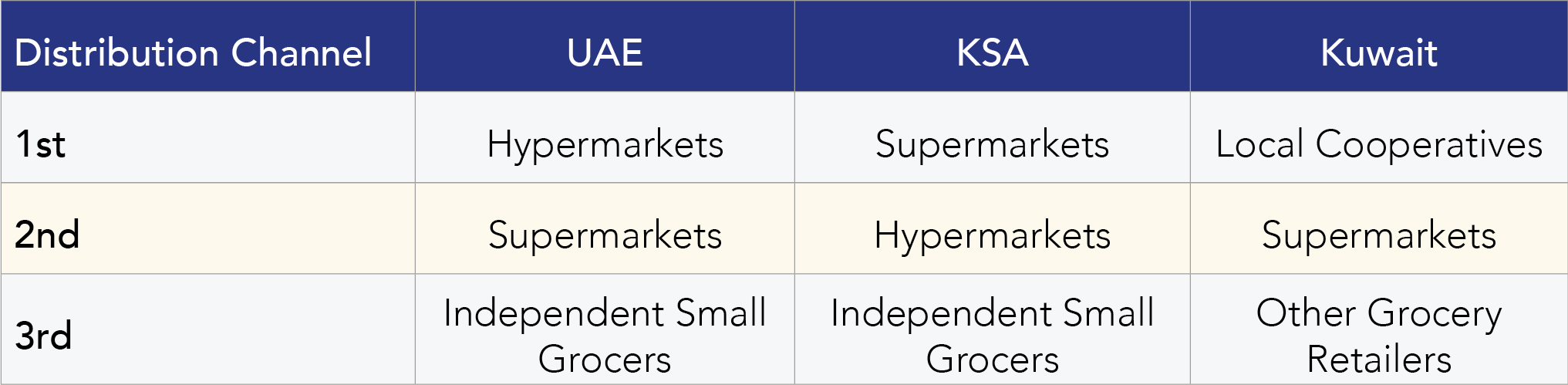

The retail landscape differs across the Gulf, with the main retail distribution channel of the UAE being hypermarkets, supermarkets in KSA, and local cooperatives in Kuwait.

When targeting Kuwait in particular, getting into the local cooperatives can take longer than more traditional retail channels, however once you’re in the opportunities are fantastic.

If you’re interested in the main trading partners of our spotlighted countries, we can see that China and the USA have strong positions with the UAE and KSA, whilst Kuwait tends to trade more locally with its neighbours.

The Gulf is ideally located as a major trade passage from the East to the West, with many brands shipping their goods through Dubai’s International Airport, but why just lay-over? Why not use this region to your advantage?

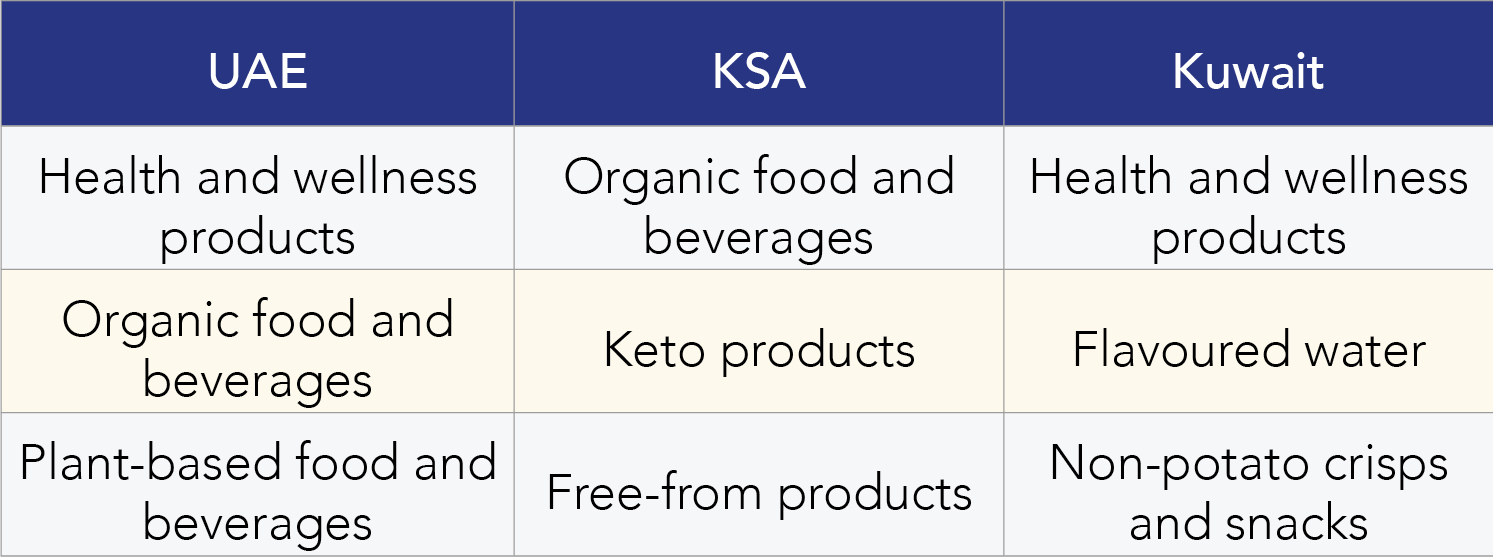

Here are our top three product spotlights for each region, based on recent conversations and deals we’ve been a part of in the Gulf. You can find out more in the export opportunities section below.

Business Practices

When doing business in the Middle East don’t expect the same practices as in the West. Business deals in the Gulf are built on mutual trust, respect and loyalty.

It takes time to build these relationships, so you need to be in it for the long-haul, taking the time to get to know your potential partners, and finding if you’re a good fit for each other.

We recommend finding local representation in the region to help ease communication and utilise the knowledge and experience of said partners.

You can find out more about doing business in the Middle East here.

Health and Wellness Market

In this section, we’re going to take a look at some of the primary product categories that we feel international H&W brands should be maximising on in the Gulf.

Forecasted sales of H&W products in the UAE are expected to reach 2.2 billion USD by 2024, with a CAGR of 13.8% between 2019 and 2024. In KSA, forecasted sales are 4.7 billion USD and 7.5% CAGR.

The data presented has been collated from a variety of Euromonitor reports. It is important to note here that, unfortunately, Kuwait is not covered by Euromonitor, and therefore it is difficult to find comparative data on such a granular level.

This should not deter you from looking at Kuwait as a potential export opportunity, in fact because it is a smaller territory, and often overlooked, there is less competition particularly when it comes to H&W.

Free from

Across the Gulf, the free from category continues to grow, for a few reasons. Consumers are more aware of intolerances to gluten, dairy and lactose, choosing free from options where available, whilst more people are decreasing the amount of meat and animal products they eat, moving towards a plant-based diet.

What’s quite interesting from the forecast period (2019-2024), is the split in product categories between UAE and KSA in that the top-five categories in KSA are all dairy or lactose related. In comparison, the split is more diverse in UAE.

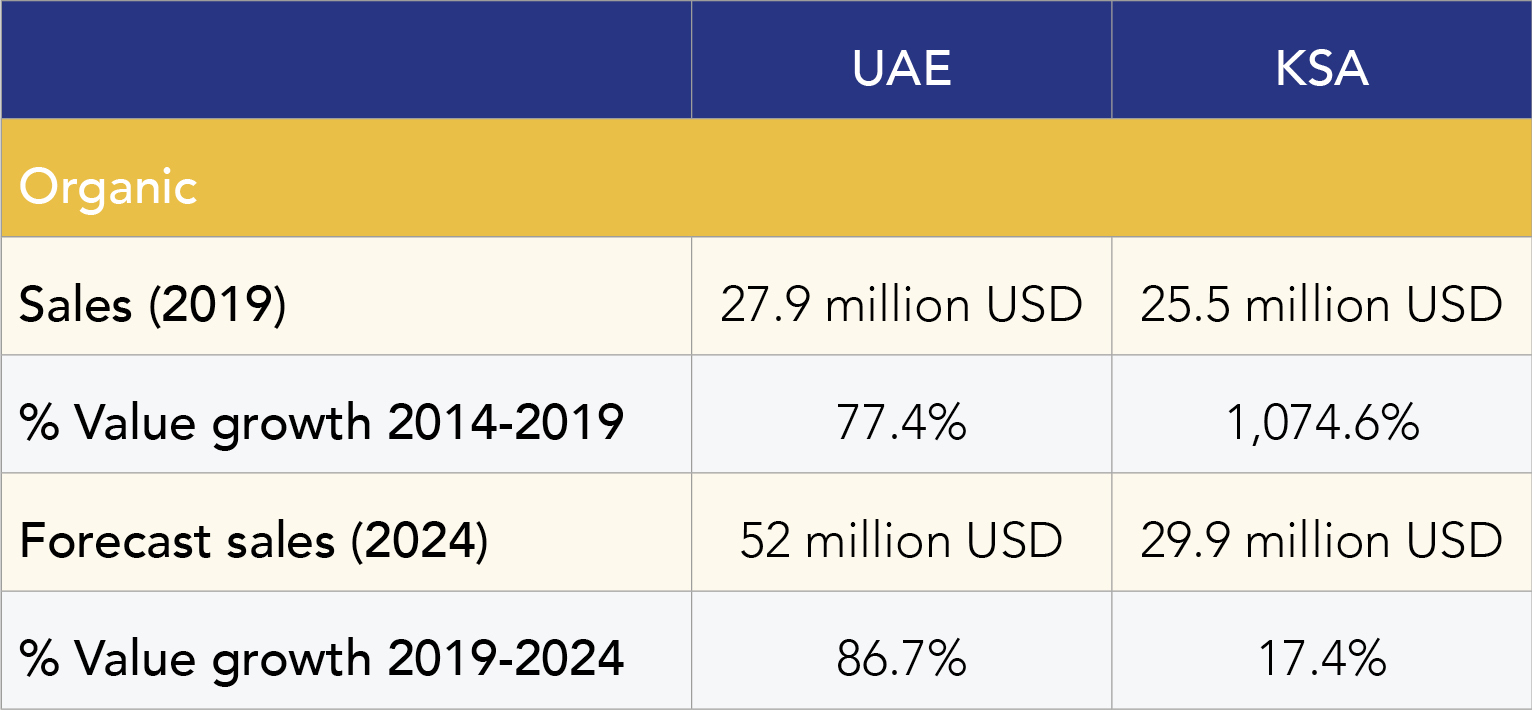

Organic

The organic sector in the Middle East grew exponentially between 2014-2019, as we can see in the table below. Although growth is expected to slow in KSA during the forecast period, there is still an opportunity for international brands to enter the market, particularly organic sweet and savoury snacks.

In comparison, the organic segment of the UAE is predicted to experience steady growth. Local consumers are starting to make more conscious decisions when it comes to what they are putting in their bodies. Ethically sourced ingredients, non-GMO, free of additives, and preservative free products are all in demand.

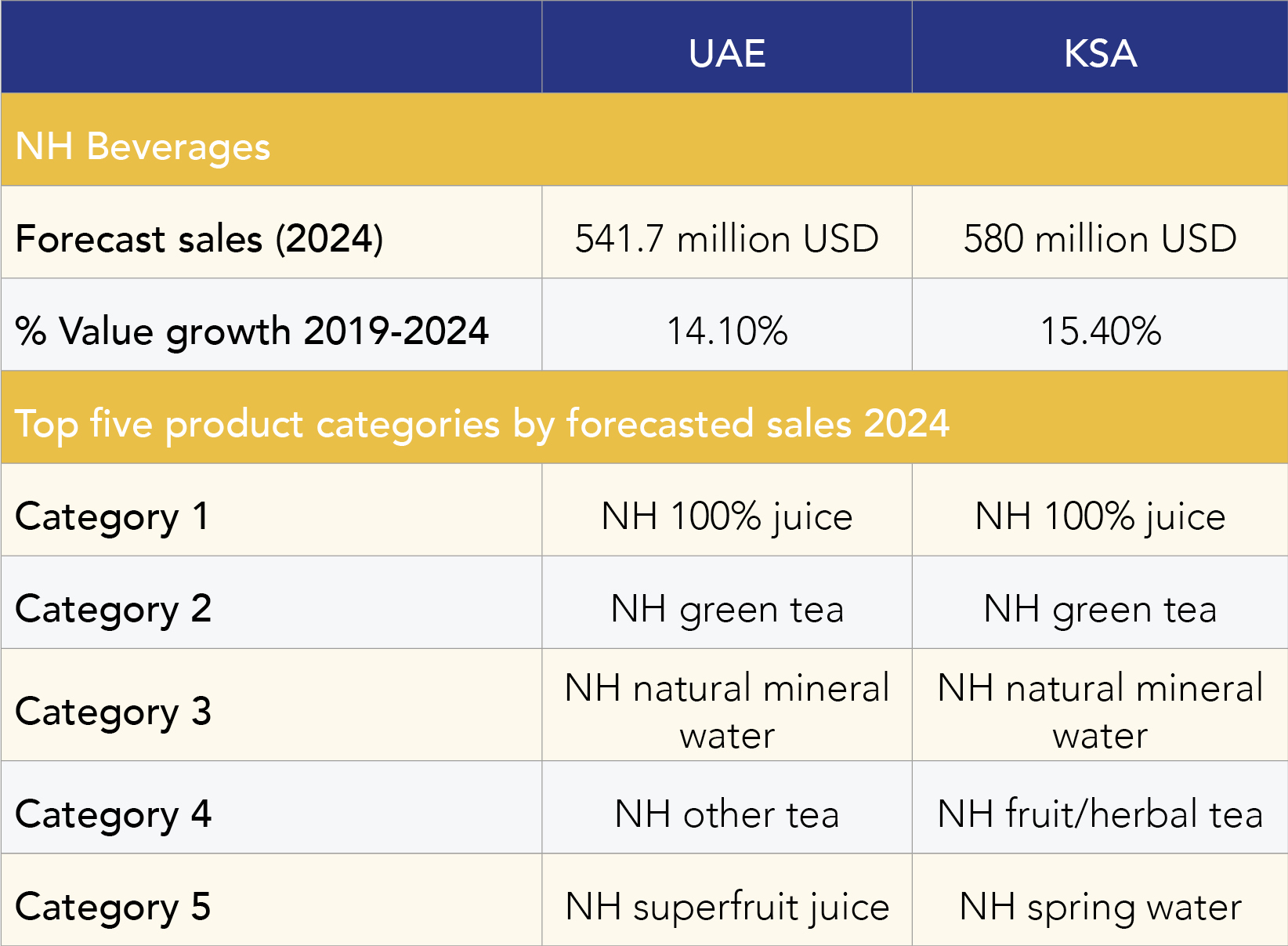

Naturally Healthy Beverages

The NH beverage category grows consistently year-on-year in the Gulf. Due to the warm climate, bottled juices, water and cold-brewed tea are commodity products across the UAE, KSA and Kuwait.

Thanks to the younger demographics, consumers are open to unusual, exotic flavours, particularly Asian beverages such as matcha and bubble tea. Fruit and herbal teas also continue to grow, as well as increased demand for carbonated drinks.

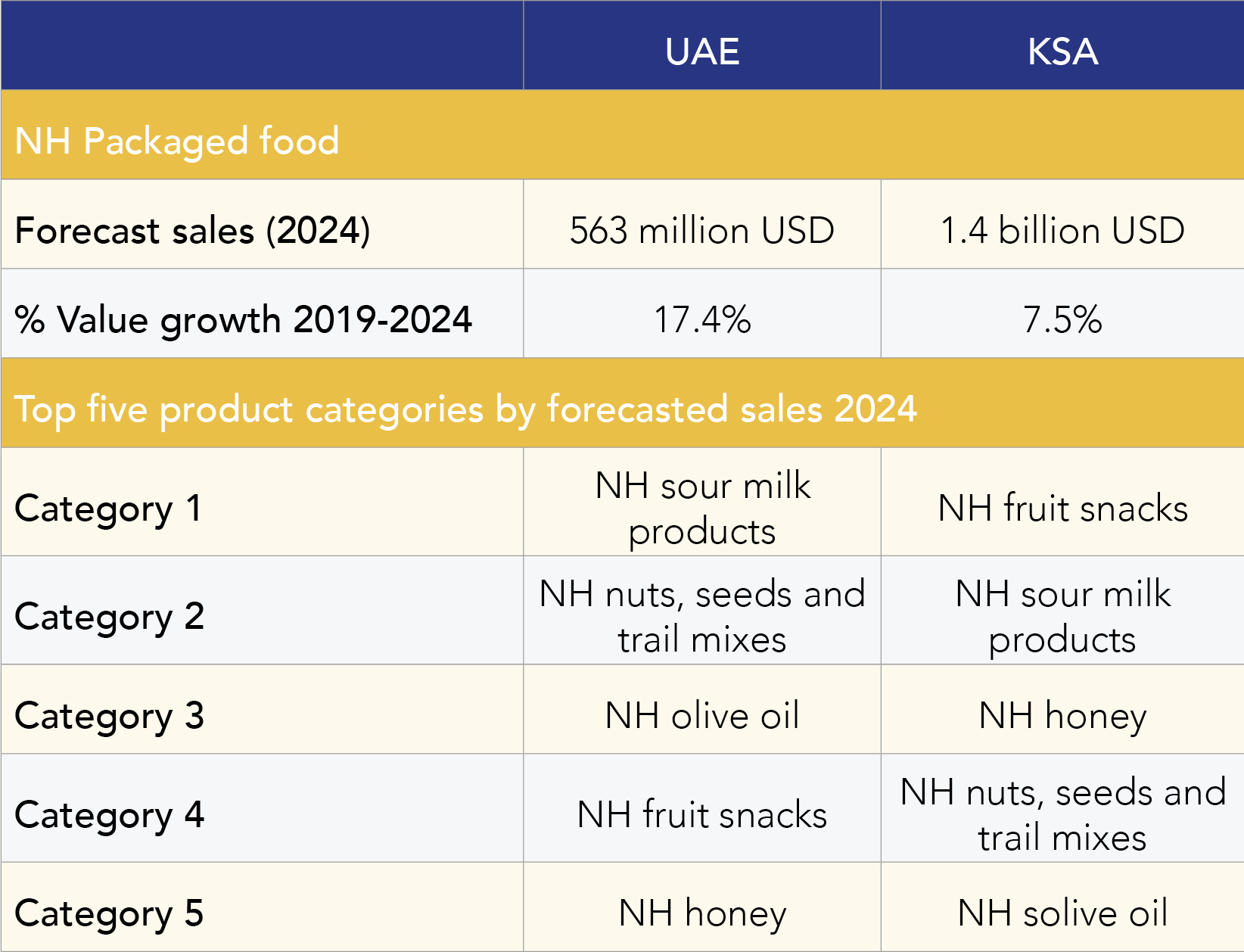

Naturally Healthy Packaged Food

Packaged foods will also experience steady growth during the forecast period, with similar demand for products across the UAE and KSA. With this in mind, we can also assume that these products are popular in Kuwait.

When combined with the organic segment, there is a great opportunity for international brands offering organic oils, honey and fruit snacks.

On a separate note, the low-carb, high-fat ketogenic diet is increasing in popularity across the Gulf region and we can expect to see more brands entering the market over the next five years. Keto is particularly popular in KSA.

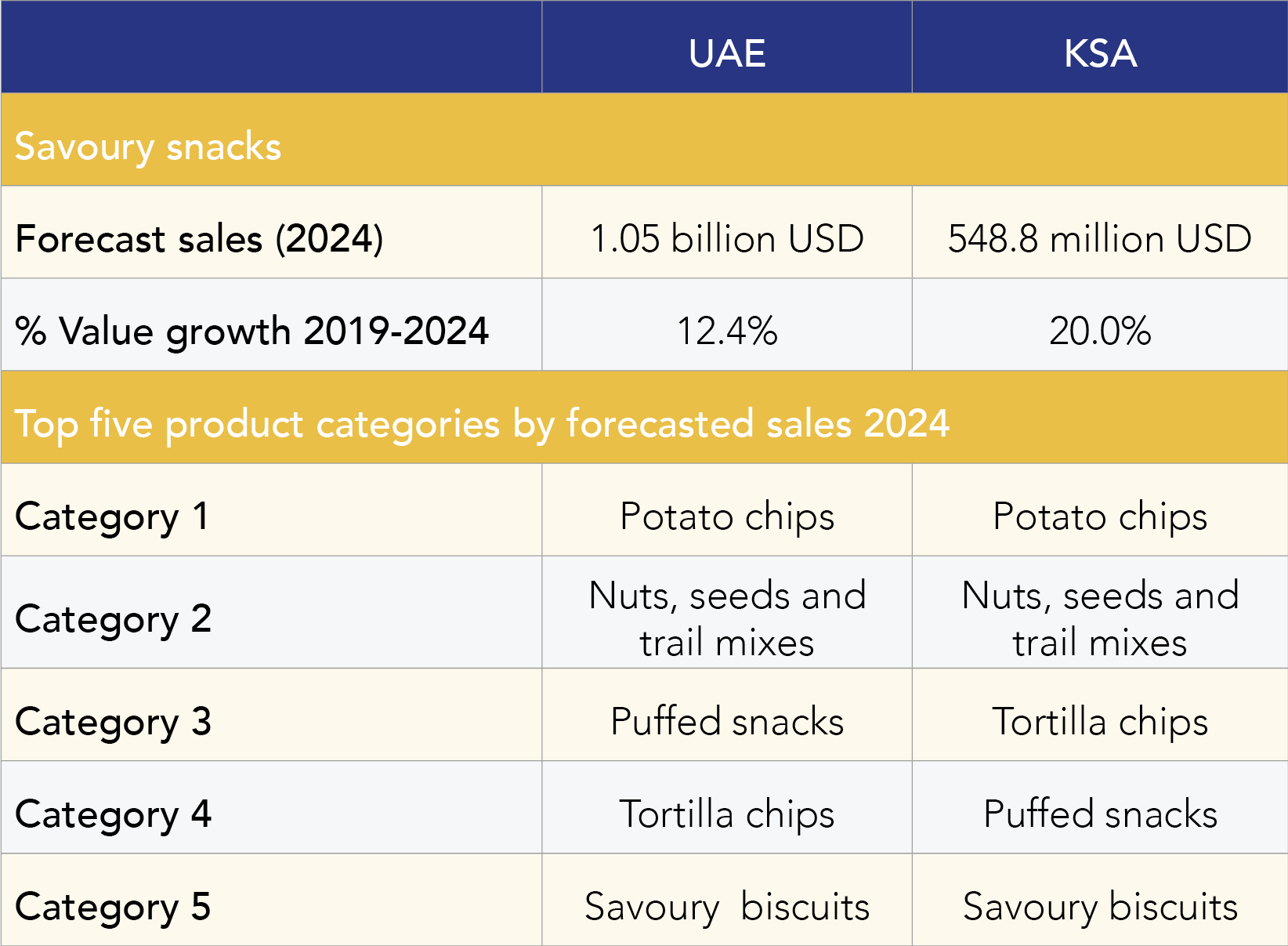

Savoury Snacks

Who doesn’t like a good savoury snack? This huge market still offers export opportunities for international brands, despite how saturated it already is. So where are the current openings?

As we’ve already seen, the organic segment is growing in popularity, as is the demand for free from products. Brands who manufacture savoury snacks that also cross into these areas are sure to maximise on the available shelf space.

We can see from the table above that the top five product categories are the same across the UAE and KSA. Due to its popularity and continued growth, the savoury snack segment allows international brands to enter multiple territories in the Gulf at once, so if this is your forte then definitely consider all three countries.

Export Opportunities for International Brands

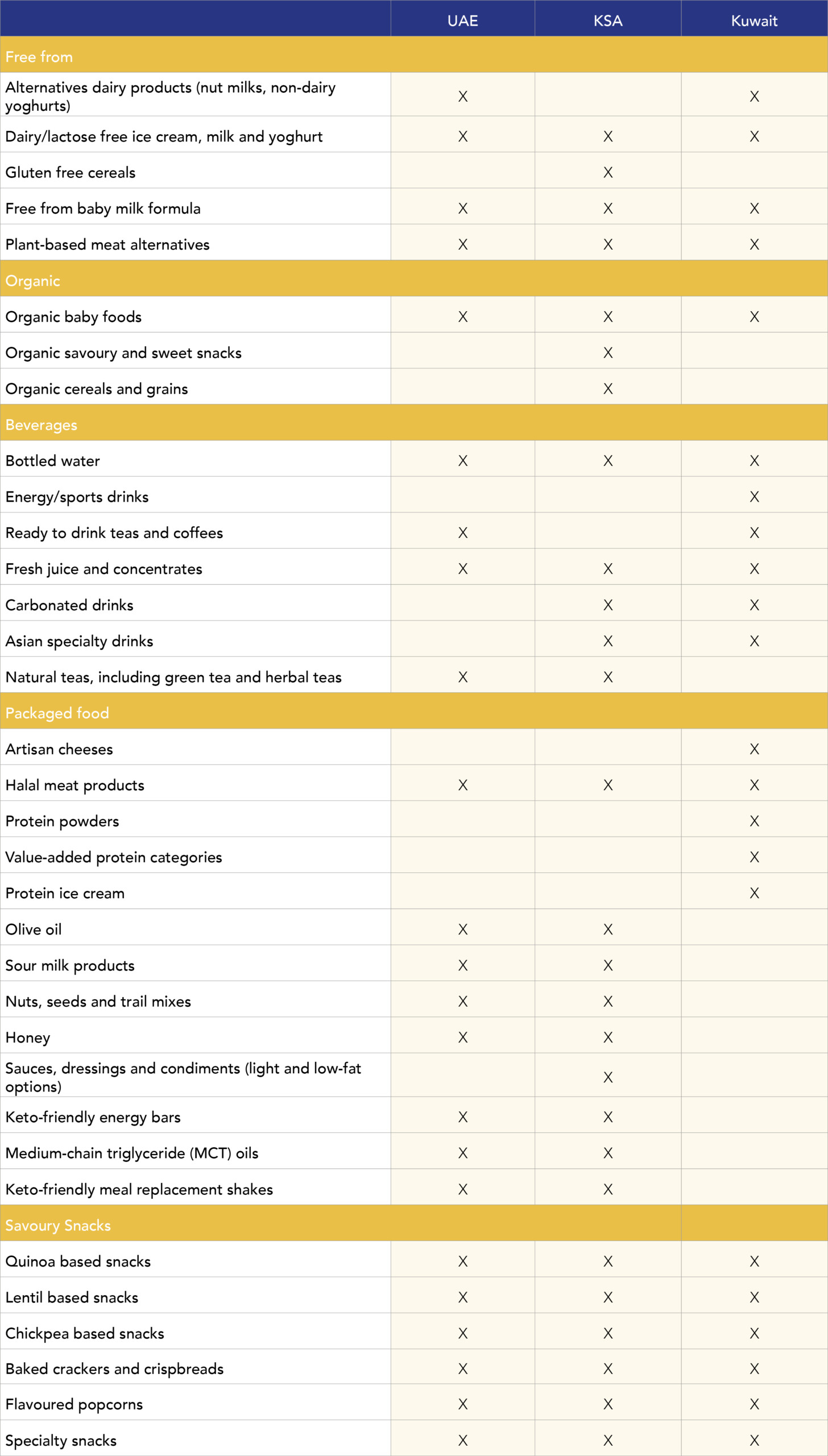

To make it nice and easy for you to spot potential opportunities for your brand, we’ve compiled this table to give you a snapshot of the markets in which your products are in demand.

If you are interested in taking the next step in exporting to the Gulf, then the Bolst Global team are here to help. Do not hesitate to get in touch to discuss your needs.

Further reading

Want to learn more about a specific market? Then look no further than Bolst Global’s Resource Hub. We’ve collated a few of our favourite articles to get you started.

United Arab Emirates

- Exporting food and drink to the UAE

- Health and wellness in the UAE

- Bolst Global’s online market access programme for the UAE

Saudi Arabia

Kuwait