Supermarket Chains in Saudi Arabia

The major players in the supermarket and hypermarket retail landscape of Saudi Arabia

The major players in the supermarket and hypermarket retail landscape of Saudi Arabia

Saudi Arabia is home to approximately 36 million citizens, with a medium age of 31.8 years old[1]. GDP per capita reached 25,215 USD in 2021 which is considerably higher than the average across the rest of the MEA region (4,045 USD). Between 2022-2040 Saudi Arabia’s economy is expected to grow at a CAGR of 2.3%.

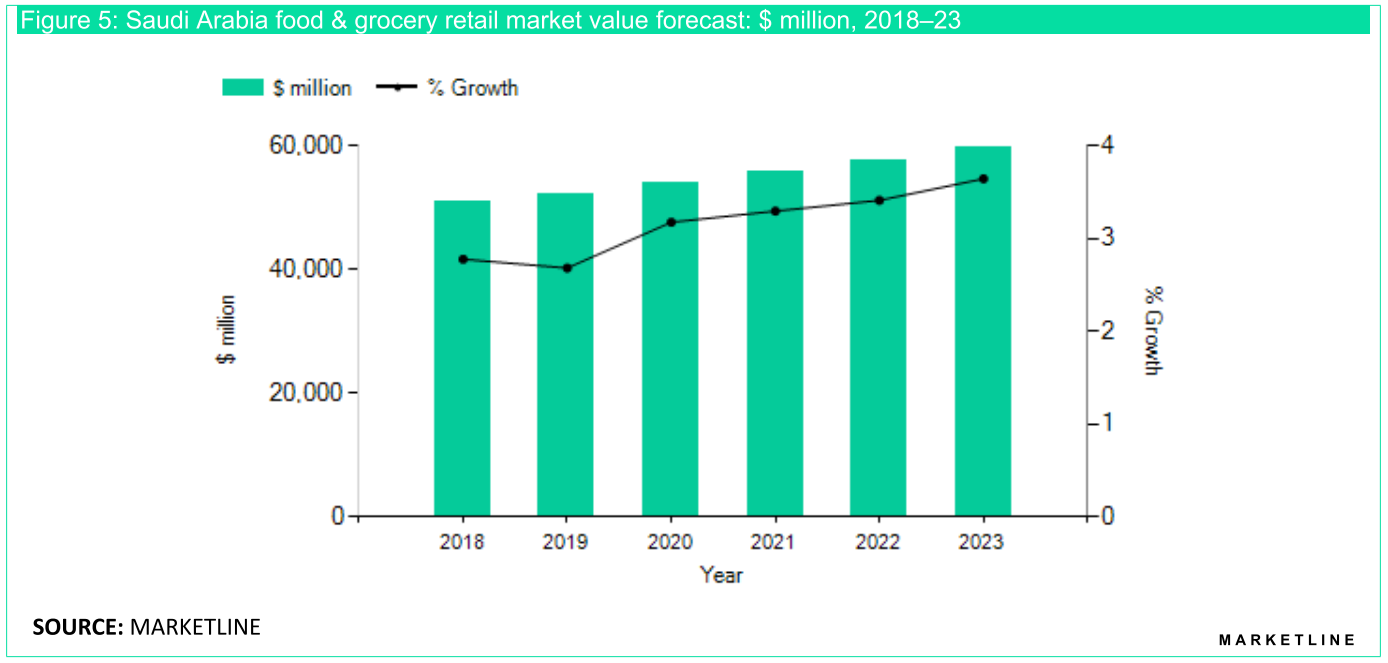

All of these factors contribute to the food and grocery retail market in the country, which is forecast to reach 59,816.9 million USD in 2023, an increase of 17.3% since 2018[2].

Food is the largest segment in the category accounting for 70.5%, whilst drinks make up a further 19%.

Historically, the grocery retail market has been historically split into what those in the region call Traditional and Modern Trade.

The former refers to the large baazars that for many years made up the cornerstone of trading in the country, but in recent years the Modern Trade channel has come to the fore and comprises of many retail chains.

Within the Modern Trade channel, convenience stores and petrol stations account for a 31% share of the Saudi Arabian food and grocery retail market value. Hypermarkets, supermarkets and hard discounters account for 19.3%.

Let’s take a closer look at the retail landscape in more detail.

Retail landscape of Saudi Arabia

Given the vast geography of the Kingdom of Saudi Arabia it is fair to say that some chains dominate with their number of outlets and/or market share in specific regions and others in other regions, however, there are definitely some key players in the market.

The tables below illustrate the top five supermarket and hypermarket brands in Saudi Arabia, according to Euromonitor, based on number of outlets.

| Brand | Company | Outlets |

|---|---|---|

| Al Othiam | Abdullah Al-Othaim Markets Co | 192 |

| Panda Supermarket (Savola Group) | Panda Retail Co | 141 |

| Farm Superstores | Saudi Marketing Co | 84 |

| Al Raya | Al Raya Markets Trading Co Ltd | 56 |

| Bin Dawood | Bin Dawood Group | 15 |

| Brand | Company | Outlets |

|---|---|---|

| Hyper Panda (Savola Group) | Panda Retail Co | 60 |

| Tamimi Markets | Tamimi Group | 52 |

| Danube | Bin Dawood Group | 38 |

| Carrefour (Carrefour SA) | Saudi Hypermarket LLC | 16 |

| Lulu Hypermarket (Lulu Group International LLC) | Emke | 14 |

These leading players are well-entrenched in the market thanks to customer loyalty and brand recognition. But where they truly overtake the smaller retailers and traditional trade routes, is through their ability to exploit economies of scale.

Supermarkets and hypermarkets have the advantage here by being able to implement aggressive pricing models which price out the smaller retailers.

Price will continue to be a core deciding factor for consumers when choosing where to shop, meaning larger retailers are more likely to succeed in the market moving forward.

For food and beverage brands looking to enter Saudi Arabia, matching your product proposition and positioning to the retailer, and their shopper profiles who are likely to be more receptive to your products, is key. Like your domestic market not every retail chain may be suitable to approach so do apply the same logic when exporting.

Pharmacies: an alternative route to market

In addition to supermarkets, hypermarkets and convenience stores, pharmacies in Saudi Arabia are another fantastic route to market for health and wellness brands looking to export to the region.

Online is growing but still small relatively speaking

The Covid-19 pandemic has undoubtedly accelerated the online capabilities and shopping habits of consumers across the world, including Saudi Arabia

As local consumers become more comfortable shopping online, retailers will continue to develop their websites, and potentially mobile applications, to enable their customers to conveniently shop online should they wish.

Omnichannel retail models will become more popular in Saudi Arabia too, with some significant steps being taken across the region already.

There have been significant investments in infrastructure, logistics, payment methods, digital marketing, and expanding product offerings.

E-commerce should not be seen as a threat for existing retailers across Saudi Arabia. In fact, many of them are already benefitting from partnerships with third-party delivery apps like Quick Market by Hungerstation which promises delivery in just 20-minutes. During the pandemic, many convenience stores and smaller retailers took advantage of the quick commerce (q-commerce) infrastructure, which continues today.

Another emerging retail model in Saudi Arabia is the introduction of “Dark Stores”, which act as retail distribution centres specifically for online customers. Popular enterprises include Noon Daily, Quick Market, Daily by Talabat, Nana, and Carrefour. As well as fulfilling orders placed online, these dark stores also offer click-and-collect for consumers wanting to place their order online, but collect in person. This is another shopping habit which is increasing in popularity across the region.

In 2021, despite emerging as a significant retail channel, e-commerce sales remained small, marginal or negligible depending on the source. But this is expected to grow considerably over the coming years in line with population growth, rising urbanisation, and the government’s implementation of its Vision 2030 initiative.

Consumer trends and opportunities

Like in many countries across the MEA region, there has been a post-pandemic health and wellness boom.

Consumers are becoming increasingly aware of the benefits of healthy eating, quality ingredients, nutrition, home-cooking, and allergens. This is also spurred on by changing buying behaviours in the country thanks to female empowerment meaning that women are making more informed decisions when it comes to shopping.

Food and beverage categories which are currently experiencing growth include, organic, reduced sugar and salt, better-for-you, naturally healthy, and free-from.

| H&W Category | CAGR (2021-2026) |

|---|---|

| Organic | 11.4% |

| Free-from | 3.8% |

| Naturally healthy | 2.9% |

| Better for you | 1.7% |

Retailers and brands in Saudi Arabia are expected to develop product lines that reflect changing consumers needs and demands. Whether this be through private labelling, in-house product development, or bringing in health and wellness brands from overseas.

There are plenty of opportunities for brands looking to get their products on shelves in Saudi Arabian retailers, as long as you go about it the right way.

Saudi Arabia Market Trends & Culture Changes 2022

During a trip to The Gulf earlier this year, Bolst Global Founder, Victoria, penned her thoughts and experiences surrounding current market trends in Saudi Arabia. It’s a really interesting read if you’re considering expanding your reach into the region.

Top considerations when approaching retailers in Saudi Arabia

There are a variety of different routes to market when it comes to approaching Saudi Arabia, each with their own pros and cons.

From working with a local partner who can make introductions with their networks and help get you in front of the right people, to distributors who already have established relationships with retailers across the country.

Of course, you can always go direct to retail, but be aware that many already work with preferred suppliers and brands so it might be more difficult for you to get a foot in the door.

With that in mind, here are some insights for when it comes to working with retailers in Saudi Arabia, from our own experiences.

Category Management is still a relatively new concept in Saudi Arabia, although it does exist with retailers. Range reviews, that many British and European suppliers will be familiar with, aren’t something we have come across when approaching retailers in Saudi Arabia. This can be helpful when trying to enter the market as you are not constrained by a specific timeframe during the year in which to present your products.

Having said that there are times of the year which can be tricky to approach for new listings. Calendar and fiscal year end, as well as the run up to the busy Ramadan period (yes despite the population fasting!) can be problematic. The summer months also tend to be much slower too and during the hottest periods many citizens spend extended time overseas in cooler climates.

Depending on your route to market then an approach to the relevant Import Manager or department within the target supermarket or hypermarket chain may be more suitable. These people are usually separate to the category management team. If a direct to retail strategy is a possible and viable approach, then this can be a good way in which to drive initial market penetration.

However, do be aware that listing fees and an investment plan may be applicable through this route. This can be where the value of working with a local partner can be helpful as they can assist in navigating with market entry. Moreover, thanks to their close relationship and multiple listings, a local partner may be in a stronger position to negotiate listings and other fees with their retailer customers than you as a newcomer.

Need support in exporting to Saudi Arabia?

This is where Bolst Global comes in. Our team has been working closely with brands, retailers, and distributors in the Middle East for many years.

Our experts can guide you through this sometimes complex landscape, and devise the best export strategy for your brand and product offering.

References

- Industry Profile: Food & Grocery Retail in Saudi Arabia, MarketLine (February 2020)

- Economy, Finance and Trade: Saudi Arabia, Euromonitor International (February 2022)

- Health and Wellness in Saudi Arabia, Euromonitor International (March 2022)

- Supermarkets in Saudi Arabia, Euromonitor International (March 2022)

- Hypermarkets in Saudi Arabia, Euromonitor International (March 2022)

- Convenience Stores in Saudi Arabia, Euromonitor International (March 2022)