Top Practical Things to know About Exporting to the United Arab Emirates

Having attended the Gulfood food and beverage exhibition in Dubai for the past few years and undertaken various assignments for clients in this market here at Bolst Global we are attuned to this increasingly attractive market and the trends and requirements which contribute to its significant reliance on imports. The UAE is the UK’s 12th biggest export market, and as a fast growing tourist destination as well as benefiting from an increasing expatriate population, it forms a major potential destination for many health food brands. Here are just three of the things we found out in our in-depth research and attendance at the Gulfood event:

Routes to entry and requirements might not be what you expect

When exporting to a new market, it is all too easy to fall into the trap of not knowing or being prepared for the differences in requirements between the UK and other countries. In the UAE, for example, religious aspects means that any products containing meat (no matter how little!) must have a halal certification. It must also have the ingredients listed in arabic at the very least (though a sticker may be used for this), as well the manufacture date and the expiry date in indelible ink. No more confusing UK ‘best before’ date!

Don’t get caught out by the ways to get your products into stores, either; most retailers prefer to buy through intermediaries such as a consolidator, who will have the advantage of being able to import small quantities instead of buying in bulk, and may smooth out any labelling changes you need to make. Alternatively, you may choose to go through a distributor, which cover all sectors of the trade, and may offer support with the local market and product regulations as well as some of the marketing and awareness raising of your brand.

Know that the UAE is heavily reliant on some imports

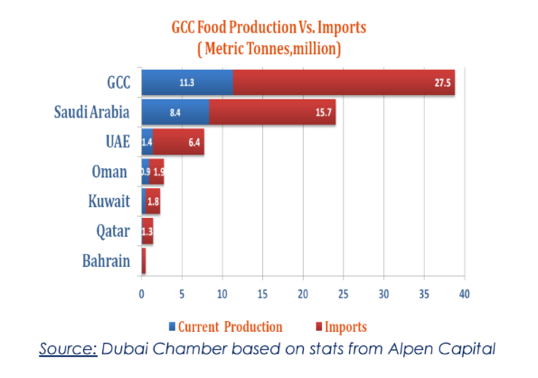

As seen in the graph, many of the countries which make up the Gulf Cooperative Council (GCC) import a large quantity in comparison with their overall food production, and the UAE is no exception. This is due to the harsh climate and scarce potable water, which strongly limits agriculture and makes farming more expensive. This obviously also impacts upon retail prices: due to high import rates and costs of growing locally, consumers wishing to purchase organic goodscan expect to pay 4-5 times the amount for conventional products. See our blog post on organic foods in the UAE to find out more.

Another product which is largely imported is dairy: many UK brands of yogurts and cheese can already be found in many retail outlets in the UAE, and the Middle East and North Africa (MENA) is the second largest region for dairy imports.

Be aware of changing trends and new opportunities

> Free-from: According to findings by Euromonitor, there is a growing niche for free-from (gluten-free, lactose-free, etc), organic foods, diabetic products and functional products. This is largely due to increased awareness of issues surrounding health and food; 66% of men and 60% of women are considered to be overweight, and one fifth are diabetic, leading the government to seek solutions to improve public health. Such initiatives have included the Dubai Health Association which placed stationary bikes in all DHA facilities with the intention of later extending to other public spaces.

> Sports/fitness foods: Interest in health and fitness is especially prevalent among the younger population, where choosing to live and eat healthily is seen as an attractive lifestyle, and alongside this attitude the UAE is seeing an increase in sales of sports nutrition products, weight management products, and vitamin supplements. Sports nutrition products saw a 98.5% value growth from 2011 to 2016.

> Drinks: There is also a growing market for tea; the region makes up 25% of all global tea imports, and is largely dominated by traditional loose tea and traditional black tea, although popularity for green and herbal teas is increasing too. In other drinks categories, islamic restrictions on alcohol have led to a strong growth in non-alcoholic drinks, amongst which the demand for soft drinks is moving more towards healthier or flavoured drinks. Again, the climate is an influencing factor here and sales of bottled water are particularly important.

Want to know more about how your business could begin or continue its journey to another export market in the UAE? The good news is that with our detailed research and tailored guidance, we can equip you with all you need to make the best decisions for your brand and gain traction in this very diverse and growing region. If you would like to know more, please fill in the contact form below

*All data obtained from Euromonitor and BCB 2016 report, accessed August 2017