The pharmacies of Saudi Arabia

An under-utilised channel for Health and Wellness brands

International health and wellness brands often overlook pharmacies as a viable retail channel for their products because shopping habits in the West are very different to the Kingdom of Saudi Arabia (KSA) and the rest of the Gulf.

Saudi consumers will usually seek out the professional opinion of a Pharmacist or Doctor when looking to take vitamins, minerals and supplements. They will specifically go to a pharmacy to purchase such items as well as baby food, rather than pick them up at the supermarket with their regular groceries.

With this in mind, let us introduce you to the pharmacy landscape of the KSA, the main retailers and distributors, and some of the key health and wellness opportunities in this market.

Why are pharmacies a channel to consider for my health and wellness brand?

The pharmaceutical sector in the KSA has grown at a steady rate for the last decade and will continue to grow at a CAGR of 9.0% by 2026.

Key drivers in the region include high population growth, solid government funding, a conscious shift to the private healthcare sector, and an increase in the number of low-cost generics being produced locally. These factors make Saudi Arabia a “perfect storm” for foreign companies looking to enter the market.

Outside of the KSA, according to Kuick Research, the Gulf region is expected to double its pharmaceutical drug market, reaching 20 billion USD by 2025.

In addition to these factors, and similar to neighbouring GCC countries, the percentage of the population that suffer from diabetes and heart disease continues to rise in the KSA. Pharmacies are seen by local consumers as a trusted source for all health-related goods as they actively seek advice and guidance from Pharmacists.

There is also a general consumer preference for more costly, brand name drugs, which tend to only be available by prescription or over the pharmacy counter.

Due to high footfalls and demand for non-pharmaceutical products, pharmacies across the KSA are actively looking to expand product ranges across the health and wellness spectrum.

How is the pharmacy market structured in Saudi Arabia?

There are over 5,000 pharmacies across Saudi Arabia. Many of which are more accessible to smaller communities outside of urban areas than supermarkets or hypermarkets.

Because of this, there has been a recent trend for Saudi pharmacies to expand their reach by introducing ‘golden branches’ to offer consumers a much wider range of products; not limiting themselves to traditional categories of medicines, personal hygiene, cosmetics, infant care, etc.

These ‘golden branches’ resemble the retail experience offered in western pharmacies such as Boots and Superdrug in the United Kingdom and CVS and Walgreens in the United States.

Some of the larger pharmacy groups, including Al Dawaa and Al Nahdi, are rolling out loyalty schemes and promotional discounts to attract consumers from all socioeconomic backgrounds.

This has also helped the larger chains to dominate the pharmacy space as they are able to provide a competitive advantage to health and wellness brands and distributors, over smaller, independent stores.

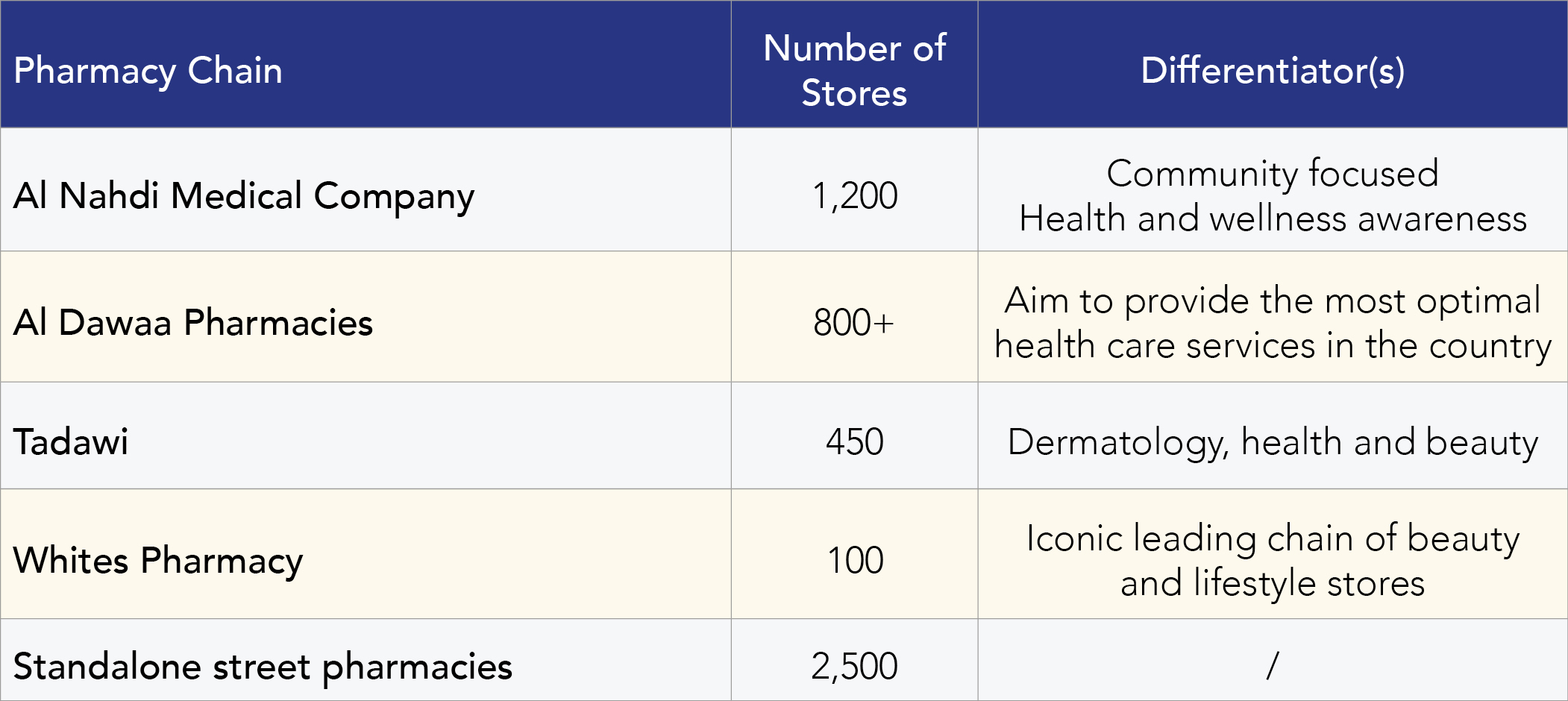

The table below represents the key players in the KSA pharmacy sector.

In 2020 it was reported that Al Nahdi Medical Company was preparing to go public through talks with potential advisors and investors. The company’s equity is valued at 10 billion Riyals (2.67 billion USD), which is set to grow exponentially over the next five years.

If you can get your products on the shelves offline and online of Al Nahdi then your reach in KSA will be significant.

Who are some of the major distributors for the pharmacy channel?

Before we introduce the main distributors in the KSA, it is incredibly important to note that even though foreign companies are allowed to set up their own production plants in Saudi Arabia, all pharmaceutical products must be distributed through a local agent.

This means that most international brands – regardless of where the products are made – collaborate with at least two local distributors, typically granting exclusive rights to particular product ranges or items for a specified period of time.

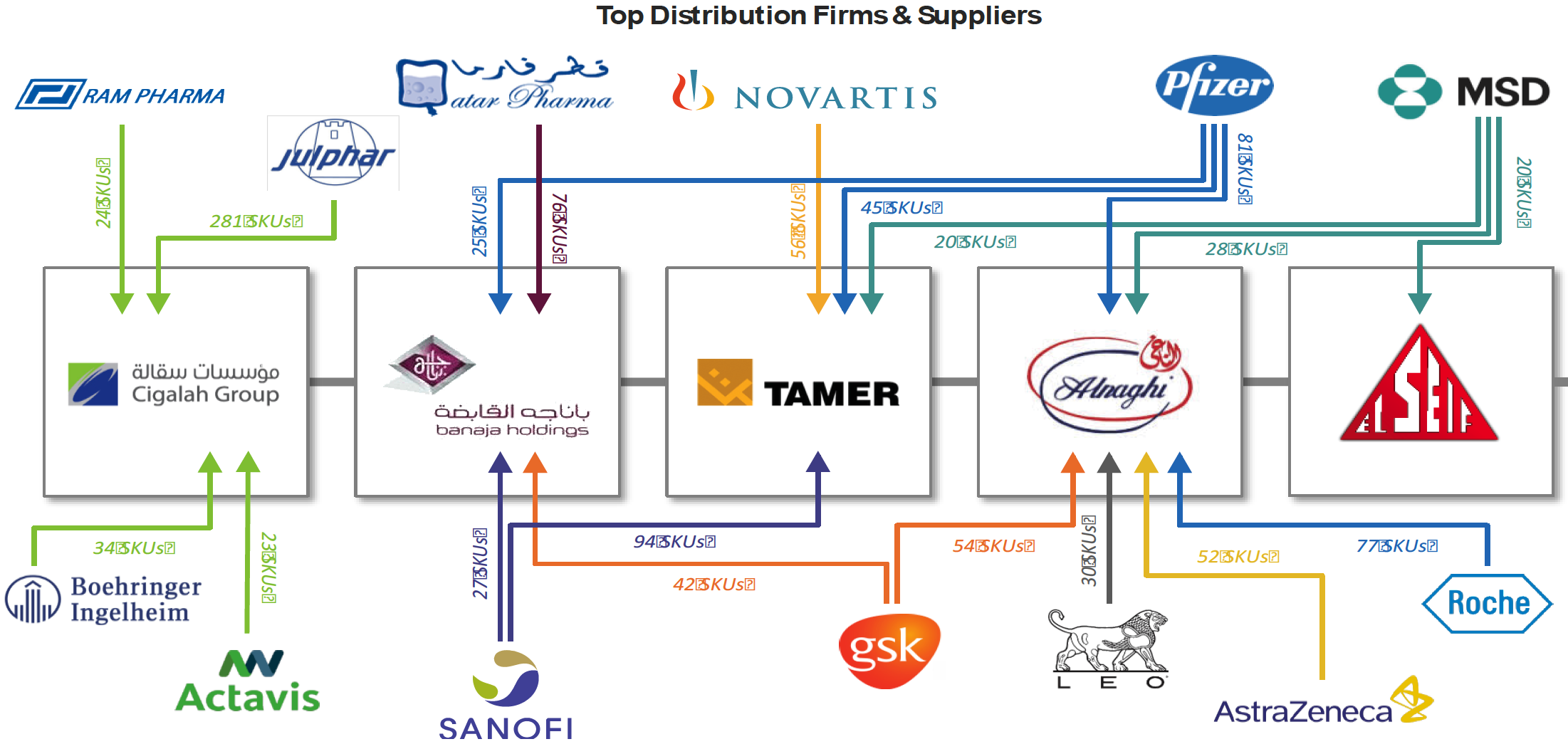

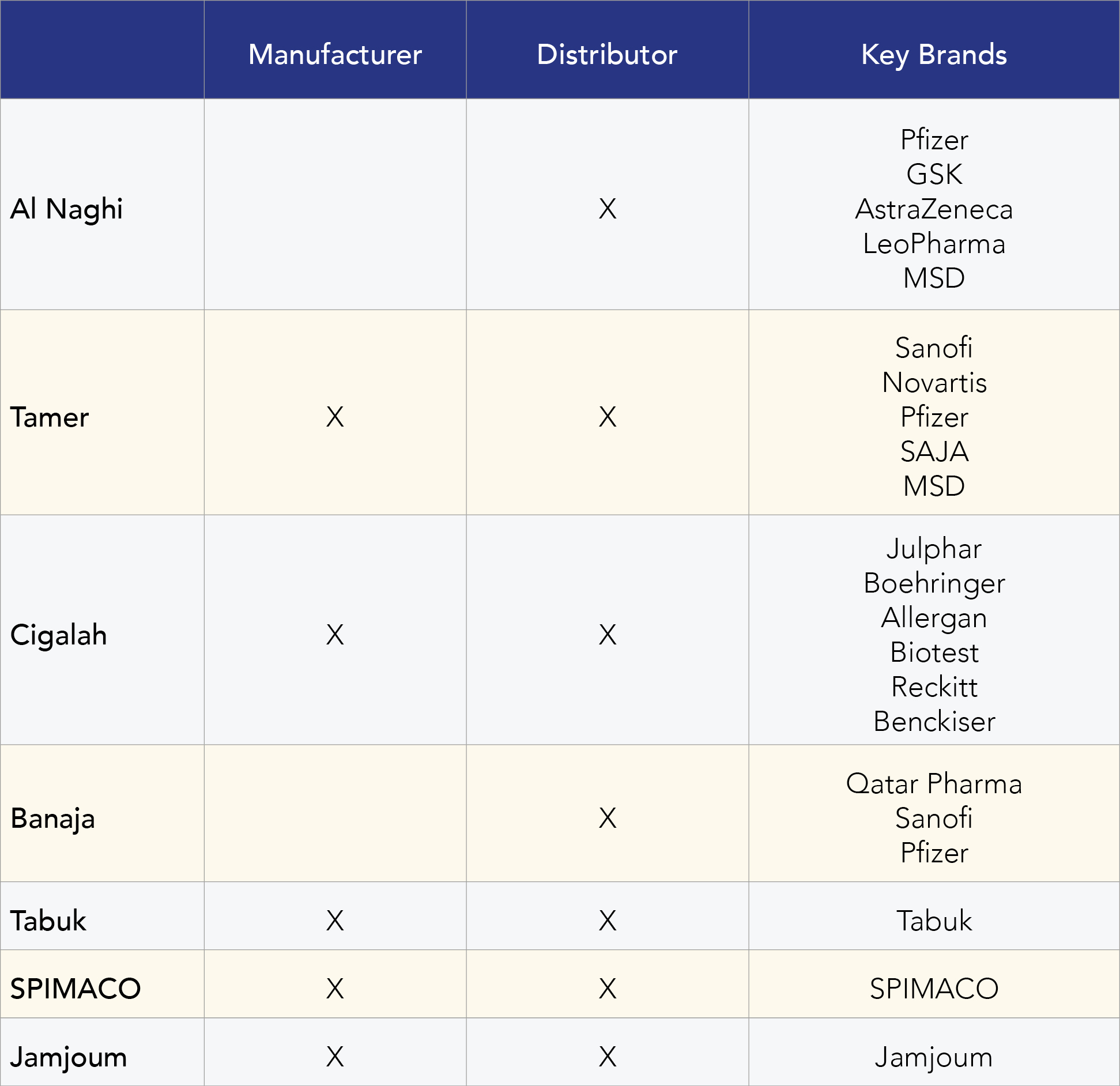

The table below highlights the seven biggest pharma distributors in the KSA, some of which also manufacture their own products.

We’ve also made a note of the key pharmaceutical brands that they work with currently to give you an idea of specialism.

In terms of market share, Tamer Group and Al Naghi dominate the space accounting for 18.5% and 13% share respectively.

What opportunities are there for my health and wellness brand?

Thanks to Bolst Global’s relationship with pharmacy retailers and distributors in KSA, we have identified three health and wellness product categories that present fantastic opportunities for brands looking to branch into the pharmacy channel.

Weight management products

Due to high obesity levels in the country, plus other chronic conditions like diabetes, there is continued demand for weight management and diet products. Recently, we’ve seen that products made from organic ingredients or free-from friendly products are incredibly popular in KSA too.

General supplements

Vitamins, minerals and other supplements are some of the main health and wellness product categories sort after in KSA pharmacies. Supplements should usually be in either a semi- solid, powder or liquid format.

However, solid supplements can only be sold in pharmacies if the product and manufacturer are SFDA registered and approved. This can be a challenge for international supplement companies looking to export to KSA due to the high cost and process that this involves. The registration process can be lengthy and domestic producers tend to be favoured. Something to bear in mind when targeting the region and how viable your products may be as a result.

Health food, snacks and beverages

Healthy alternatives, particularly snacks and beverages, are increasing in popularity throughout the GCC region, but in Saudi Arabia brands that are able to stock products on pharmacy shelves will open themselves up to new audiences.

Branded products will do well, whilst the larger pharmacy retailers are strategically increasing their reach and brand equity by sourcing new health and wellness products through private labelling. This provides any manufacturers open to providing private label to the pharmacy chains a sizeable business opportunity.

Who can help me to connect with pharmacies in Saudi Arabia?

If you’re a brand owner looking for help assessing the market potential for your products, or need support navigating this particular channel then let us know. We have supported many brands with market entry information and intelligence to allow them to successfully navigate this dynamic, changing landscape. You can also find more about the health and wellness market of Saudi Arabia here.

If you’re interested in making connections in the KSA then the Bolst Global team can also help. We have links with several pharmacy retailers and a variety of distributors of health and wellness products.

Our team is also experienced when it comes to supporting both international and domestic pharmacy retailers and distributors in sourcing high-quality and innovative products and suppliers. You can find out more about our services here.

And if you’re not sure if Saudi Arabia is the right market for your brand, check out this recent comparison of the health and wellness sector across the Gulf region, where we compare the KSA with the United Arab Emirates and Kuwait.