The Food and Drink Landscape of Kuwait

Export opportunities in an overlooked area of the Gulf

We’ve written a lot about export opportunities for food and drink companies looking to make it in the UAE and Saudi Arabia, however, there is one country that is often overlooked when it comes to the Middle East, and that’s Kuwait.

If you’re looking to branch out overseas, Kuwait might provide you with a great dynamic marketplace for you to enter and Is definitely worth considering If the Middle East Is a target export region for you.

This small but wealthy country is particularly fond of British products, and local consumers demonstrate strong purchasing power, especially when it comes to experimental products and trying something new.

So, without further ado, let’s jump straight in and found out more about the food and drink landscape of Kuwait.

Demographics

Located at the tip of the Persian Gulf, Kuwait borders Iraq to the north and Saudi Arabia to the south. It is part of the Gulf Cooperation Council (GCC) along with its neighbours, Saudi Arabia, the UAE, Bahrain, Qatar and Oman.

With a population of 4.27 million, Kuwait is smaller in comparison to other GCC countries, but like the UAE, has a high number of expatriates. In fact, 70% of Kuwait’s population are expats.

Life expectancy in the region is 78.6 years, with a median age of 29.7 years. This is something brands should bear in mind when deciding on how to target local consumers.

As previously mentioned, Kuwait is a wealthy country and is currently ranked as having the 29 th highest GDP per capita in the world.

But what does this all mean when it comes to food and drink?

Food and beverage landscape

Kuwait currently has the fastest growth rate for food consumption in the whole GCC area, with the sector expected to grow by 9.6% per annum over the next five to ten years.

If we look at the average monthly household expenditure on food and drinks, we see the following split across the population.

| Kuwaitis | Expats | Nationally |

|---|---|---|

| $9,200 USD per month | $2,300 USD per month | $4,300 USD per month |

In 2018, the total value of food imports to Kuwait was around $1.8 billion USD, with the main trading partners being GCC neighbours the UAE and Saudi Arabia, as well as Germany.

According to Statista, the revenue generated by the Kuwaiti food and beverage segment is expected to reach around $34 million USD by the end of 2020. And, thanks to a projected CAGR of 10%, the market may be valued in excess of $50 million USD by 2024.

This strong growth rate can be attributed to the increasing population, rising disposable incomes of younger generations, plus constantly shifting trends amongst consumers.

As a result of the COVID-19 pandemic, food and non-alcoholic drinks will see a boost in sales in 2020 as local consumers are prioritising essential goods over desirable items. The health and wellness segment will also experience higher growth as people are becoming increasingly more health conscious.

Routes to market

From a retail perspective, the current divide in Kuwait is as follows: local cooperatives account for 60% of the groceries landscape, supermarkets 20%, and other stores such as mini-markets, pharmacies and specialist stores make up the remaining 20%.

Therefore, in order to get your products in front of consumers, you need to first register with the Kuwaiti government’s Union of Consumer Cooperative Societies (UCCS). The UCCS controls all grocery stores and supermarkets in the area, leaving little room for private players to enter the region.

Typically, you will find one main co-op in each neighbourhood which is then surrounded by several smaller co-ops of the same group. There are now over 100 cooperatives throughout Kuwait. Since the local community have shares in the co-ops, this is where their loyalty lies. If you want to succeed in Kuwait, you have to be in the co-ops, there’s no question about it. At present the main way to access the co-ops is via a local partner so ensuring you work with one who has access to this channel Is crucial to success from a modern trade perspective.

One important consideration here, which relates back to finding a great local partner, is that even once you’ve listed with the UCCS, you still need to pitch to each individual cooperative in order to get your products onto shelves. It certainly takes work on the part of your chosen partner, but it will be well worth the effort in the long run for all involved.

Product categories

Health and wellness

The health and wellness sector generally performs well across the whole GCC region, but it has certainly increased in popularity in Kuwait over recent years.

Despite being the fourth most obese country in the world 7 , Kuwaiti consumers are really into sports nutrition products and healthy organic foods which are growing rapidly due to popularity and demand.

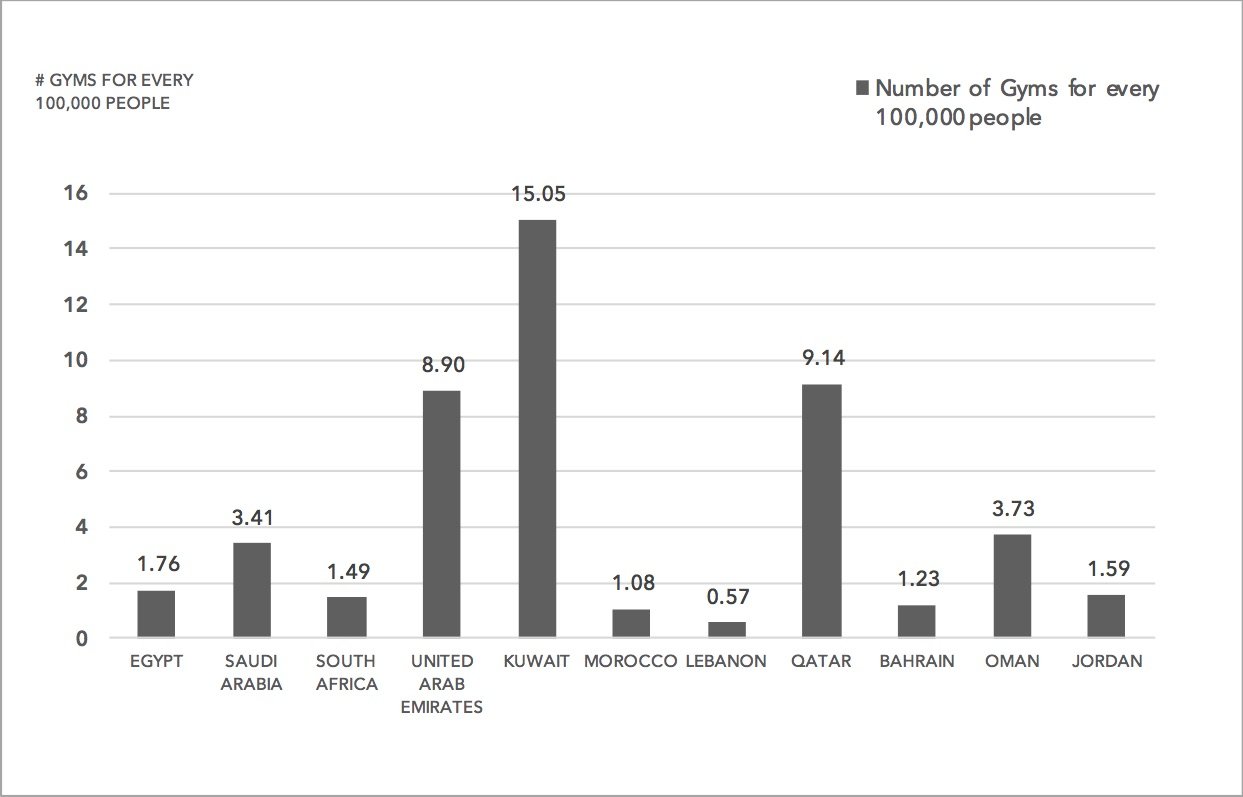

This is supported by the continued growth of the fitness service market in Kuwait, which has been predicted to see a CAGR of 9% between 2017-2022. In addition to this, a 2016 study found that, across the whole of the Middle East region, Kuwait had the greatest number of gyms, equating to 15 gyms for every 100,000 people.

Although we have no recent data to corroborate this, we can anticipate that these numbers have risen over the last four years.

Throughout our own travels in Kuwait, the Bolst Global team have seen whole aisles dedicated to value-added protein products in local cooperatives. Here are some of the current export opportunities for health and wellness brands looking to enter Kuwait.

Flavoured water

Due to Kuwait’s hot climate the demand for soft drinks and bottle water is constant. However, this demand grows exponentially in the lead up to Ramadan.

When fasting, the Muslim population of the country must stay hydrated at all times and plain, old water just doesn’t cut it when it comes to flavour and the additional sugar from syrups and beverages Is seen as highly beneficial to consume when breaking fast.

One brand which has thrived in this market is UK-based Vimto. The berry cordial first entered the Gulf in 1927, which still remains the biggest market for the brand outside of the UK.

In fact, Saudi Arabia, Kuwait and the UAE still remain the biggest consumers of Vimto out of the domestic region 10 . Annual sales in Saudi Arabia and the UAE equate to $9 million USD, with 80% of sales during Ramadan.

The demand for sparkling and flavoured waters continues to grow, the same goes for soft drinks, particular in the food service industry.

It is important to note here that in other GCC countries recent government restrictions and taxes have come into place for food and drinks which are high in sugar. Although this does not currently apply to Kuwait, it is something to consider if you are thinking of exporting into the country.

Export Opportunities

Non-potato crisps and snacks

In connection with the healthification of many food and drink products in the region, Kuwaiti consumers are becoming more aware of the

ingredients and nutritional value of the produce they consume.

Locals are keen to see more non-potato crisps and other snacks, plus snacks that do not contain MSG, trans-fats, preservatives, allergens and GMOs, on grocery store shelves.

Carlos Portales, Regional Marketing Manager (MENAT), Kerry Taste and Nutrition recently said this of the snack market in Kuwait:

“This is a small, growing segment with some new launches emphasising baked, less fat, less sodium, no MSG and natural ingredient claims.”

With this in mind, exporters in this product category should see many opportunities if their items provide added nutrients such as vitamins and fibre, whilst maintain a great taste for their customers.

Export Opportunities

Other opportunities

In addition to the product categories we have highlighted above. There are also other opportunities in Kuwait, for food and drink brands who produce the following items:

And, there we have it. Let’s summarise what we’ve learnt about Kuwait.

This small but wealthy country in the Middle East presents huge opportunities for global food and drink exporters looking to take a good market share in an often-overlooked market.

Kuwaiti consumers are becoming increasingly interested in health and wellness products, especially those with value-added protein.

The cooperative societies hold the largest share of the retail landscape in Kuwait and exporters need to secure a local partner in order to get products onto the shelves. This is where Bolst Global can help thanks to our large network of retail buyers, distributors and other stakeholders in this market who we work with.

If you’re interested in branching into Kuwait, then you can keep up to date with current export opportunities here, or do not hesitate to get in touch to discuss your individual needs. We look forward to hearing from you.

Sources:

https://www.statista.com/outlook/253/249/food-beverages/kuwait

https://www.oganalysis.com/industry-reports/218002/kuwait-food-and-beverages-market

https://store.fitchsolutions.com/all-products/kuwait-food-drink-report

https://worldpopulationreview.com/country-rankings/most-obese-countries

https://yvespreissler.com/fitness-landscape-kuwait-middle-east/

https://www.esquireme.com/why-arabs-drink-vimto-ramadan-iftar-facts

https://www.ft.com/content/3a7e17f4-25a2-11ea-9a4f-963f0ec7e134

https://www.marketresearch.com/Business-Monitor-International-v304/Kuwait-Food-Drink-Q2-13155921/