Saudi Arabia Food Imports – Health & Wellness Market Insights

Import and export opportunities in Saudi Arabia

There are a lot of misconceptions when it comes to doing business in the Kingdom of Saudi Arabia (KSA). Of course, there are challenges when it comes to entering the market, but no more than any other country situated in the Gulf. Like the UAE and Kuwait, building lasting relationships is the key to success in the region. If you’re willing to be patient and put the work in, then it’s a great place to do business and there are plenty rewards to be reaped.

In the latest in our series of market insights for the health and wellness sector, we tap into the opportunities available for food and beverage brands in KSA, with a focus on organic, free-from, and keto product categories.

So, let’s start by getting to know the market and the habits of the local consumer.

Saudi Arabia Demographics

Saudi Arabia is the second largest Arab country, and the largest nation in the Persian Gulf region, with a total population of 34,813 million. Out of this total, 60% is under 35 years of age.

In recent years, KSA has become rather westernised and this young population is very susceptible to western trends. They are both dynamic and local in their behaviours, valuing innovation and tradition in equal measures.

This has also led to the rise in young, female consumers with newfound purchasing power. Thanks to the younger female generation’s increased independence and personal income, this presents an opportunity for brands to maximise reach by targeting this demographic. Young females are willing to invest in health and wellness brands, particularly premium, quality products.

One important thing to note is that KSA is often perceived as having a wealthy population, but that isn’t the case for the majority of the population. Most consumers have limited disposable income so brand owners should bear this in mind when developing export pricing strategies and/or negotiating with local retailers/distributors.

Food and beverage landscape

The food and beverage market in Saudi Arabia has changed considerably in recent years, with consumers making more conscious decisions when it comes to healthy eating. According to Euromonitor, the health and wellness (H&W) sector is expected to reach 17.8 billion SAR (4.7 billion USD) by 2024.

Like neighbouring country UAE, KSA has high obesity and diabetes rates. The government, as part of the Saudi Vision 2030 plan, has financed a variety of projects with a focus on improving health and wellness across the region.

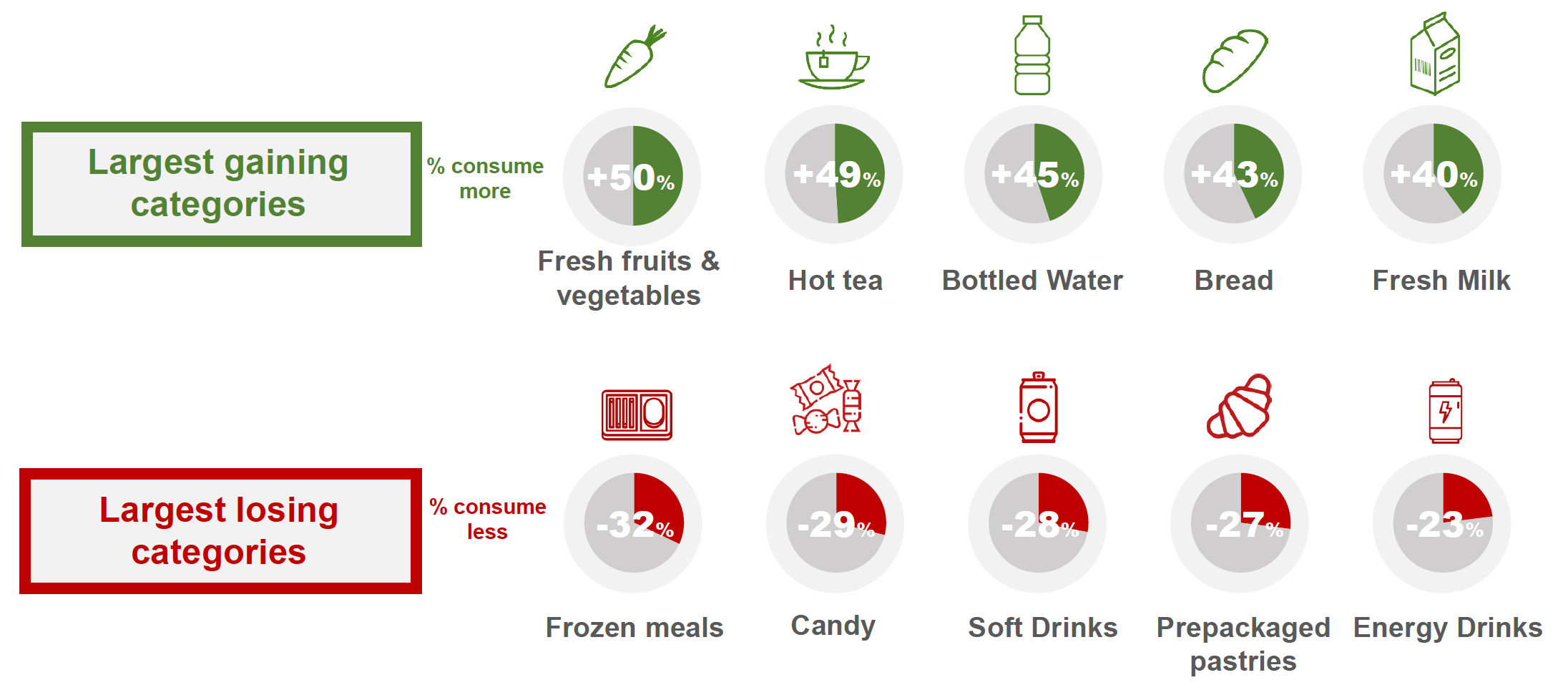

During the Coronavirus pandemic, around 50% of consumers have become more mindful of what they eat and drink, with many eating more balanced meals. This increased awareness has been helped by ongoing promotional activities from health and wellness brands, seeing consumers staying away from sugary and fatty products.

In 2019, the Saudi government rolled out a tax on all beverages high in sugar, doubling the price of eligible drinks. The sugar tax is part of the drive to encourage the population to make healthier choices. With all these facts in mind, it’s clear to see that there is a great opportunity for H&W brands to enter this emerging market.

It’s important to note that there are certain labelling and packaging requirements for food and drink products entering KSA. For example, you must not mislead the consumer or make claims about your product which can’t be backed up. You can find out more about the requirements of the Saudi Food and Drug Authority (SFDA) here.

Routes to market

According to Euromonitor, the dominant distribution channel of H&W produce across KSA in 2019 was grocery stores, supermarkets and hypermarkets. This channel provides a great opportunity for both local and international brands and manufacturers, through both branded and private label product lines fo Saudi Arabia imports.

There are a number of local and international players already active in the market. For example, Abuljadayel Beverages Industries LLC, Nestlé Saudi Arabia, and Mondelez International, but independent brands will also do well in KSA.

Another growing route to market is through the foodservice industry. The Saudi government has invested an incredible amount in boosting tourism across the country, competing with the UAE, through the Visit Saudi campaign. This provides a variety of opportunities for H&W brands through travel and hospitality partnerships.

Similarly, to other Gulf countries, finding the right distribution partners is key in KSA. Here are some useful tips to help get you started.

Product categories

Now we have a good idea of the food and beverage market in Saudi Arabia, let’s take a look at three fast growing H&W product categories that present numerous opportunities for international brands.

Organic

The organic food segment in KSA has been a bit of a slow burner over the last few years, with a 2018 survey conducted by Arla Foods, identifying that the demand for organic produce was relatively insignificant.

That being said, there were few options available at the time, meaning high price points and little local representation. However, over the last couple of years, there has been an increase in demand, opening the door to international brands able to offer products unavailable in the local market.

In terms of numbers, the organic segment is expected to reach 112.3 million SAR (29.9 million USD) by 2024, which is by far the smallest H&W category type in Saudi. However, if we look at constant value growth rate percentages, the organic segment is expected to see the second highest CAGR, coming in just behind free-from, at 17.4%.

One brand which has benefitted from the increasing organic product category in Saudi is Hunter’s Gourmet.

Headquartered in Dubai, Hunter’s Foods was established in 1985 and is one of the most successful producers of organic snacks, seeds and powders in the Middle East. The products are 100% non-GMO, free from artificial flavours, colours and preservatives, and predominantly MSG-free.

The Hunter’s Gourmet line is sold across KSA in supermarkets, health food stores, and entertainments spaces. Finding an easy way into the market with its wide range of snacks, there is definitely room for other international brands in this segment to compete with Hunter’s, especially unusual flavour combinations and exotic ingredients.

Here are some current export opportunities in the organic category which at Bolst Global we are actively working on with our KSA based customers:

Keto

According to Fior Markets, the global keto diet market is forecast to reach 17.8 billion USD by 2026, with 2021 expected to be the breakout year for the diet trend.

Like organic products, keto-friendly food and drink is currently experiencing growth in Saudi thanks to consumers’ increased awareness of what they are putting into their bodies. For example, the KSA Better For You market was valued at 778.5 million USD in 2019, with reduced fat and reduced sugar products the most popular in this area.

In 2019, the weight loss market in KSA was valued at 1.18 million USD. This segment continues to grow at a steady rate due to high obesity rates across the country, which is where diets like keto come in.

Unfortunately, options available on supermarket shelves are still limited, with most keto products bought and sold online through specialist retailers. Local consumers are often required to make purchases from international retailers who offer a wide variety of keto products currently unavailable in KSA.

One international brand which is paving the way for others in the keto space, is Highkey. Based in Washington state, USA, Highkey prides itself on producing super tasty, low sugar and low carb sweet snacks. Top selling products include protein packed mini cookies, coconut macaroons, and powdered baking mixes.

Although the full range is not yet sold in KSA, you can find Highkey’s products on local online retailers such as Ubuy.co.sa, whizzcart.com, and gosupps.com.

Are you a manufacturer of keto products? Interested in exporting to Saudi Arabia? Here are a couple examples of export opportunities in this category:

Find out about the latest keto trends in our recent post. Equally, if you would like to put forward your brand for any keto opportunities In this market then contact us to do so.

Free-from

One H&W category that continues to do well in KSA is the free-from segment. Alongside organic food, the free-from landscape is incredibly dynamic thanks to a rise in consumer awareness of dietary intolerances, and the desire to live a healthier lifestyle.

Supported by the government’s investment in improved healthcare, including allergy screenings and nutritional support and advice, the free-from sector will continue to grow. In fact, sales of free-from packaged food are expected to reach 397 million SAR (105.8 million USD) by 2024.

One emerging sub-segment of the free-from category in KSA is gluten free products. This is a growing area thanks to a heightened awareness of gluten intolerance among consumers. Coupled with a significant portion of the population looking for healthier alternatives, we are likely to see a number of new players entering the region to cater to the growing demand.

Local manufacturer of dried pasta, Perfetto, was the first brand to bring gluten-free pasta to the market in 2019. Despite being one of the leaders in the dried pasta landscape in Saudi, there is still potential for international free-from brands to steal the limelight.

Additional free-from export opportunities for international brands, include:

Other opportunities

In addition to these product categories, there are a variety of opportunities for international health and wellness brands specialising in:

To recap, KSA is a wonderful place to do business, with a thriving and dynamic population. Thanks to the Saudi Vision 2030 there is a huge push towards healthier habits and lifestyle, meaning that attitudes towards organic and wellness products are changing for the positive.

You can find out more about exporting via our web resources as well as our previous KSA article on further health food opportunities. If you’re interested in branching into Saudi Arabia, then you can keep up to date with current export opportunities here, or do not hesitate to get in touch to discuss your individual needs. We look forward to hearing from you.

Sources:

- Euromonitor report: Health & Wellness in Saudi Arabia

- https://www.ipsos.com/sites/default/files/ct/news/documents/2020-12/food_trends_2020_-_ksa.pdf

- https://www.foodnavigator.com/Article/2021/02/01/Is-keto-tipping-to-the-mainstream-I-cannot-remember-an-underground-buzz-like-the-one-ketogenic-is-sowing/