Global Sweet Trends

The latest innovations and in-demand snacking products around the world

It probably comes as no surprise that snack foods are one of the biggest product sectors of the packaged food and beverage industry, valued at $215.9 billion USD in 2020, with a compound annual growth rate (CAGR) of 2.7%.

In the first of two articles looking at global snacking trends, we’re going to dive into global sweet trends and uncover the market size, post-Covid consumer behaviour, and the in-demand and innovative product categories taking the health and wellness market by storm.

Market size

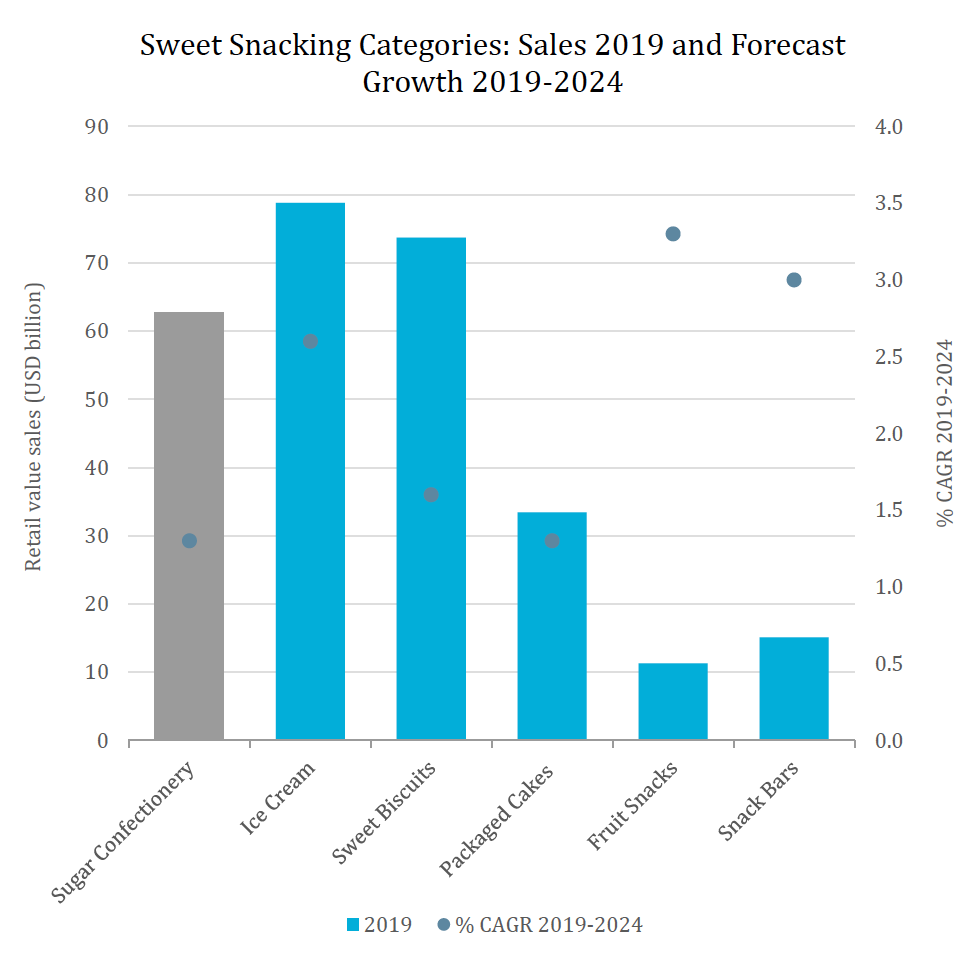

According to Euromonitor, the sales value of the sweet snacking category in 2019 was $274 billion USD, with a forecast CAGR of 2.2% between 2019-2024.

Currently, ice cream and sweet biscuits hold the market share, however fruit snacks and snack bars are expected to see the highest growth during the forecast period.

Due to the rise in government incentives to reduce sugar intake, the global sugar confectionary sector has stagnated. This has resulted in many players choosing to focus on low-sugar, functional or free-from snacks in order to find growth opportunities.

In 2020, the sweet snacking industry was driven by increased demand for healthy snack bars and fruit snacks. This was also helped by the fact that many snack bar products were able to tap into health trends such as keto, vegan, plant-based protein, functional ingredients, natural sugar, rich in fibre, and added source of protein.

The sweet snacking sector is expected to experience modest growth in 2021 as a result of the Coronavirus pandemic which has negatively impacted the global economy during 2020. However, the market is expected to recover over the next 12-months and grow at a CAGR of 7% from 2021 to 2023.

Consumer trends

The pandemic has resulted in a huge change in consumer behaviour, particularly when it comes to food and beverage. From initial panic buying and stockpiling, to a newfound love of home-cooking, consumers rekindled their relationship with food.

In the short-term, particularly Q2 of 2020, home seclusion due to lockdown measures resulted in a boost to sweet biscuit sales thanks to consumers looking for sweet, indulgent treats to snack on at home. This boost was also helped by consumers opting for larger multi-packs available in supermarkets.

At the other end of the sweet snacking spectrum, fruit snacks recorded the highest value growth in 2020 at a rate of 14%, reaching $1.5 billion USD in revenue. Fruit snacks were able to tap into the health and wellness narrative, with many consumers switching up their snacks during secondary lockdowns.

This growth was also supported by parents looking for healthy snacking options for children. As many children had to be home schooled during the height of the pandemic, parents chose processed fruit snacks over dried fruit despite the higher price point.

As society begins to return to normalcy in 2021, we can expect to see strong performance from fruit snacks, snack bars, protein and energy bars, especially as consumers look to shed their “Covid curves” at the gym.

Mindful eating will also continue to put emphasis on natural and organic ingredients, as consumers become increasingly conscious of what they put into their bodies, especially when it comes to snacking.

Product categories

As changing consumer behaviour demonstrates, we can expect that healthy snacks will continue to increase in demand and help the recovery and growth of the sector.

We have identified five sweet – and healthy – snack product categories to watch over the next few years, whilst showcasing some established and up-and-coming innovative brands from around the world.

Dried fruit, nuts and seed snacks

Dried fruit and nuts have always been a quick and accessible snack, providing both protein, fibre and healthy fat, although not as dynamic as other health and wellness snacks when it comes to format. Today, consumers are looking for on-the-go consumption and convenient packaging which is why processed fruit snacks are likely to outperform traditional dried fruit products over the forecast period.

Renowned UK brand, Whitworths is known for its high-quality baking ingredients and dried fruits. Whitworths has, however, moved with the times and consumer demands to deliver three distinct snack ranges: On-the-Go Snacks, Grazing Snacks and Evening Snacks.

Whitworths’ On-the-Go Snacks combine dried fruits, nuts, and little bits of indulgence in the form of chocolate nibs and yoghurt balls, in perfectly convenient grab-and-go pouches. Each pouch is under 100 calories, clearly appealing to those who are looking for a quick, tasty and guilt-free snack.

Alongside these ranges, Whitworths also produce child-friendly snacking in the form of dried fruit snack boxes, perfect for lunchboxes. As children return to school following the easing of lockdown, fruit snack boxes, like Whitworths’, will continue to help parents monitor their children’s calorific and nutritional intake.

Organic sweet biscuits and snacks bars

The organic food and beverage sector continues to grow in popularity year-on-year, including the organic sweet snacks category which saw strong growth of 33.6% in 2019. Organic biscuits are often associated with being better for you and continue to be well-liked by consumers.

A couple of notable brands in the organic biscuit category are Doves Farm and Back to Nature. Doves Farm has expanded its product range into biscuits made from its high-quality organic flour and baking ingredients. The recognisable UK brand continues to provide consumers with delicious, organic snacks that are readily available in supermarkets.

In 2020, Back to Nature announced a move to plant-based snacking, ending the use of animal products in its products, with the exception of honey. Its huge range of organic cookies and biscuits has helped Back to Nature reach consumers across the United States and Canada.

As we’ve seen, snack bars are going to experience the highest CAGR of the sweet snacking sector, with organic snack bars helping to drive this growth.

Up and coming brands like Honey Mama’s are also paving the way for consumers looking for organic healthy snack bars to satisfy a sweet tooth.

We can expect to see more and more snack bar manufacturers applying for organic certification over the next five years as consumer demand continues to grow.

Free-from sweet snacks

Mindful eating has brought about quite a change in the choices consumers are making when it comes to snacking. This can be seen in the rise of free-from sweet snacks targeting the health conscious, those with food intolerances, and vegetarians and vegans around the globe.

With a variety of free-from snacking options, from dairy-free chocolate from the likes of Moo Free to high protein superfood snacks from SNACK, there’s something to satisfy everyone’s needs.

Health and wellness brands should get creative in this category. Innovative products which appeal to an array of target customers will thrive. Let’s look at a couple of examples.

Everyone loves a sweet treat from time to time, and vegans are no different. UK-based CHOC Chick produces an assortment of sustainable, raw cacao products, and has branched out into the snacking space with its chocolate coated plantain bites, quinoa pops and trial mix. Unlike anything else readily available on supermarket shelves, CHOC Chick’s fun packaging and novel products are very appealing to free-from shoppers.

Free-from snacks that provide added value, like the IQBAR, are also expected to drive the growth of the product category. The IQBAR uses plant-based ingredients to deliver 12g of vegan protein, less than 1g sugar, 3g net carbs, and six brain nutrients in each individual bar.

Also, keto and paleo friendly, the IQBAR is one of those products that lies at the intersection of free-from and fortified/functional snacks. Expect to see more from brands like this.

Keto-friendly sweet snacks

The keto segment continues to grow. With increasing popularity in the Middle East and Asia we can expect to see a rise in the number of keto-friendly sweet snacks hitting shelves around the world.

Locako is an Australian brand that specialises in keto-friendly brownie bars and snacks that also fortified with collagen to promote energy, brain function, mental clarity, concentration, memory and focus. Quite distinct in its offering, Locako continues to position its products in the low carb, low sugar category, where we can expect further growth over the next couple of years.

Also prominent in the keto space is The Chocolate Trader. The Chocolate Trader’s range of healthy chocolate keto snacks fit perfectly in this category. Its range of chocolate bark and chocolate coated almonds are made with all-natural ingredients and come in handy easy-to-eat packs.

The combination of rich chocolate and sustainably sourced almonds delivers indulgent, smart snacking to keto followers, diabetics, children, and mindful eaters around the world.

Fortified and functional sweet snacks

As we’ve seen from brands such as IQBAR and Locako, sweet snacks made from diverse ingredients with fortified functions attract consumer interest. Snacks which are not only good for the body, but good for the mind, are set to be the next big thing in snacking.

In fact, this is a global trend with sweet snacks fortified with additional vitamins or minerals highly sort after in Asia-Pacific and North America. Let us now introduce you to two brands, relatively new on the scene, that are producing innovative fortified and functional snacks never seen before.

Currently available through a successful Kickstarter campaign, the AHARAbar by Spoons of Taste is a range of snack bars that not only fulfil a sweet tooth but are enhanced with adaptogens like ashwagandha and spirulina. There are currently three varieties of the AHARAbar on the market, each targeting a different functional use: calming and inflammatory, strengthening and energising, and calming and restorative.

On a similar ilk, MyAir produce snack bars that are scientifically proven to help relieve stress. Who would have thought a sweet and healthy snack bar could do that?! Made from functional super plants, the MyAir bars aim to tackle common issues such as stress, poor sleep, and enhance general mental wellbeing.

They are currently only available online in a personalised variety pack tailored to each individual. Unlike other brands in this category, MyAir use artificial intelligence to monitor and improve its products through its mobile application where subscribers are encouraged to track their progress. The data is then used for future R&D.