France, as a lot of countries, is a place that you definitely should consider if you want to export health food and drink products. The French Food & Beverage consumption amounts around £158 billion. It consists in around 16.000 companies that employ almost 400.000 individuals which is quite similar to the situation in the UK. According to Euromonitor, France is the 2nd largest packaged food market in Europe and the 5th largest in the world. France and the UK are close partners when it comes to doing business. Indeed, France is the UK’s third trading partner in terms of export sales according to Worlds to Export.

The French health food and drink sector

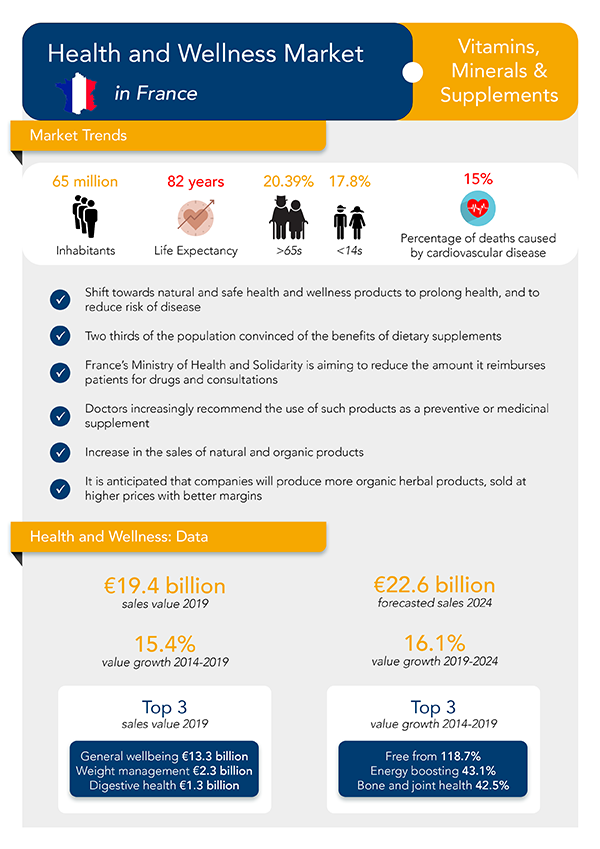

The rising interest in health food and drink by the French consumers is not just a trend, they are really interested in having a healthier lifestyle and are increasingly concerned about their diet. The ageing population is also another factor, with the population aged 65+ representing around 12 million of the overall population which accounts for 19% of the entire French population. Having a healthy lifestyle is something the entire French population feel really concerned about- it is not simply generational.

What are the key trends?

Eating smart is the point. Today, people do not eat just for pleasure but also for the benefits which these foods provide to them. Indeed, it is common practice in France to consume whole grain pasta because of the high rate of fibres they provide or eat oleaginous fruits for the proteins, fibres, many minerals and vitamins they offer. Ingredients are becoming and sometimes associated with “alicament” that is a mix between the French terms “aliment” (food) and “médicament” (medicine). Beauty from within is a strong idea growing in popularity.

Another trend for the French is trying to consume less meat and alcohol and more fruits, vegetables, and mineral water. For example, according to a 2017 study published by the association Avec Modération!, in 2016 the French reduced their alcohol consumption with the idea of consuming less but better. Indeed, the daily alcohol consumption in constantly decreasing and was 10% less in 2016 with 18% of the people interviewed declaring not consuming alcohol at all anymore.

Regarding food, the French are encouraged to consume more fruits and vegetables and it is common to see TV campaigns from the Ministry of Health promoting the benefits of eating well and having a healthy lifestyle with the idea of practising at least a physical activity. Indeed, the programme “Manger Bouger” launched in 2001 with the purpose of improving the health of the French highlights the high concern of the government regarding public health.

According to a poll published on 2017 by Harris Interactive France, the French revealed cooking more and 71% declared looking for information about their food on the Internet whilst 11% admitted going on consumers discussion groups and public health websites.

What we can notice also is that there are more and more consumers who are eating outside their homes and buying meals “on the go”. France is a highly-urbanised country (almost 8°% of the whole population) and people living in the urban areas benefit from a higher disposable income which implies they are the main target of these kind of foods. Added to that, the demand is constantly increasing, all of which explains the growth of snack outlets and consumption in urban areas.

The French also love snacking outside of meal times. According to a study published by the CREDOC for Mondelez International, 86% of French people interviewed declared snacking without feeling guilty. According to the same study, 38% of the people admitted snacking at least once a day. Indeed, eating something between breakfast and lunch is something very common and the sames goes for the “goûter” at 4 pm.

What the French also appreciate, is the traceability of what they buy. In the supermarkets, especially when it comes to meat, they are now demanding that the origin and the details of the product appear on the packaging. It is common practice for the manufacturers now to put a logo or a label on their packaging to indicate the origin of the meat. Consumers are used to seeing these logos now and are definitely more educated and forms part of their purchasing decisions.

It can clearly be a competitive advantage to be honest with French customers as trust is something they are really emotionally attached to. The demand for certification and labelling is mostly due to the past food scandals. People are now more vigilant and are seeking these certifications to trust manufacturers again. The way you choose to communicate around your product is absolutely something decisive in France as the French are really sensitive to this. Even though it can be more expensive to buy French meat, the French would rather buy it instead of buying something less expensive but not of indicated origin.

The retail landscape: who are the main players?

- Large retailers

The most well-known large retailers are Carrefour, Leclerc and Auchan. As of 2018 and according to their website, Carrefour has 247 hypermarkets in France, according to the newspaper La Croix. Leclerc has 541 as of this year too and Auchan had 260 in 2016 according to Statista.

Carrefour have been the pioneer regarding the introduction of organic and healthier products. They recognized the opportunity and decided to launch in 2013 their own label “Carrefour Bio” which offers a wide range of interesting products for the French customers.

In the meantime, they have also launched “Carrefour bio” stores with 4,000 product lines available in 19 stores (mostly in the Paris region). This offers the possibility for customers to do their shopping in a shop exclusively dedicated to organic products

Leclerc and Auchan want also to be part of the success. Indeed, Auchan launched in 2012 their own organic stores “Coeur de Nature” in order to make the breakthrough into this competitive market. However, they only opened 2 stores and the results were not as successful as expected. Eventually, the company launched “Auchan bio”, the first store opened on November 2017 and they are confident in opening more in the coming months.

Obviously, the retailers are willing to open more organic stores but they are still seeing how the land lies at the moment.

If you are used to distribute your products through large retailers in the UK, then you should definitely consider the ones mentioned here to reach the French market.

- Discount supermarket chains

Chains such as Lidl and their 1500 stores or even Aldi with their 900 stores in France have entered the market and offer wide ranges of organic and healthy products.

Lidl and Aldi would be a natural progression for your brand in France if you distribute your products through discount channels in the UK.

- Specialist channels

Some channels in France have dedicated their entire business to healthy products and are very successful. Among these:

– Biocoop (431 outlets as of January 2017)

– La Vie Claire (339 outlets as of May 1st 2018)

– Naturalia (400 outlets as of 2016)

– Naturéo (56 outlets as of 2018)

All of them show quite impressive results and are constantly opening new shops as the demand is continually growing. Indeed, the fact that the French are now a bit suspicious towards large retailers and mass-produced products have obviously favoured the emergence and the development of the specialised channels (Biocoop opened 40 outlets in 2016 and now have over 400 outlets at present for example). La Vie Claire projects to open 8 franchises for this quarter which highlights the great future ahead for these specialist channels.

You should definitely consider specialist channels if you offer organic and high quality products!

- Gourmet and premium channels

The mystique of French gourmet cuisine is undeniable. The French cuisine wants to be assimilated with sophistication, refinement, fineness and elegance. From the famous foie gras to cheeses and escargots, France’s gastronomy is truly traditional and unique. What the French love is good food and therefore the French are these kinds of customers willing to pay more if the products are of higher quality and to their liking. The French are “bon vivant”, they love eating good food and drinking good wine. It can seem stereotypical, but this is actually true! Premium and gourmet products are therefore unsurprisingly very trendy products. Some stores are specialised in the distribution of these products such as the famous Galeries Lafayette and La Grande Epicerie de Paris.

These stores are mostly visited by the well off, however for the special occasions such as Christmas or even just when you want to offer a premium product to someone (offering food is something really common and appreciated in France), these stores are visited by everybody.

The competition between all of these players in this channel is becoming stiffer and this is expected to continue over the forecast period. Thanks to their power in the business, large retailers benefit from the best possibility to offer to the French customers to possibility to access to health and wellness products. Moreover, thanks to their loyalty programmes, they are able to understand more the needs of the customers and adapt their offer. However, at the moment, the specialist chains remain the leaders in this market.

The Gourmet chains are a distribution channel you definitely have to consider if you have a high end premium product and you want to enter the French market.

British food consumption in France

The French love their cooking, it is said that they are chauvinistic, however they are open and love tasting products from all around the world. During the last decade, the opinion of the French about the British food has definitely changed. Remember in 2005 when the French president Jacques Chirac said “You can’t trust people whose cuisine is so bad” … Well thankfully times and perceptions have changed. Opinions around British food and drink products is much more positive and British brands are well received. To be honest, there is still some work to do. However some brands such as Tyrell’s or Quaker oats are very well received as they promote this authentic and traditional image of Britain. All of this shows that there is definitely a place for the British products in the heart of the French! Even the most classical and traditional products such as Cheese (think about the famous Camembert) now face competition from British cheese such as Cheddar or blue Stilton. For example, the brand Wike Farm sells their Cheddar in Carrefour and according to a 2016 article, France was the second importer of British cheese just behind Ireland.

It is now common place to see in the supermarkets for example some British products such as crumpets or scones. Most of the large retailers have a section or aisle in their stores dedicated to foreign food, and that dedicated to British products is getting bigger and bigger.

The expansion of British retail chains such as Mark and Spencer and Pret A Manger have also no doubt played a key role in the presence and the perception of British food and drink products. Indeed, with the quality of the products they offer, these chains spread the idea that British food and drink products do have a rightful place in the French market.. Also, the fact that more and more French travel and go to live in the UK contributes to spread this idea that “decent food does not end at Calais”.

If you would like to explore the market opportunities in France for your brand, we can help you navigate the French landscape through market research, insights and business development support. Please complete the contact form below and one of our team will be in touch.