Understanding The New HFSS Legislation

Retail restrictions for high fat, salt, and sugar products in the UK

In October 2022 the new UK high fat, salt, and sugar (HFSS) legislation will officially come into place, but what exactly does that mean for consumers, retailers, and brands?

In short, the new legislation puts certain restrictions in place for those products identified as being HFSS. These restrictions are related to in-store location, promotional offers, and marketing activities.

Part of the UK government’s “Obesity Strategy”, the HFSS legislation aims to encourage adults to change their purchasing behaviour, diet, and overall lifestyle.

The date that the legislation comes into play has been pushed back a couple of times to allow for the relevant changes to be made, and there is a chance that this could be pushed back again as some of the restrictions are being contested since local stores and corner shops that have much smaller square footage would struggle to implement some of the new rules.

What restrictions will come into place?

There are three main areas where restrictions will be enforced:

1. Restricting where HFSS products can be located in-store, so retailers will not be able to put HFSS products…

2. Restricting promotional offers such as multibuys and buy-one-get-one-free promotions for HFSS products

3. Restricting advertising of HFSS products both online and on television, with televised adverts not allowed pre-watershed (before 9.00 PM)

The proposal goes into much more detail, so for more information please refer to GOV.UK.

What do brands and retailers need to do to prepare?

There’s no easy way to say this, but brands and retailers will have to adapt to the impending changes, and, now more than ever, they will have to work together to thrive in the wake of the new regulations.

Market Research company, IRi Worldwide, recently published a report entitled “How will the HFSS regulations impact FMCG brands?” in which five possible options were outlined for food and beverage brands to consider ahead of the October 2022 deadline.

Let’s take a look at these now…

1. Accept the ban, with manufacturers and retailers absorbing a loss of £192 million GBP

2. Move advertising spend to the post-watershed slot, resulting in an anticipated loss in sales of £112 million GBP

3. Reinvest advertising spend in other channels, with a potential loss of £96 million GBP in sales

4. Advertise alternative low-fat, salt, and sugar (LFSS) products, but with a much lower penetration rate, lower returns, and a lower halo impact – a potential negative impact on sales equating to £80-100 million GBP

5. Re-formulate HFSS products so that they become compliant with new HFSS restrictions

The fifth option may be the best option for manufacturers in the long run, however it is also the most complicated and time consuming.

IRi Worldwide predict that this will result in the lowest impact on sales at a loss of around £30-75 million GBP. This does not, however, include the costs incurred for re-formulation, new product development, or the impact incurred by potential back-lash from consumers.

Around 78% of food and beverage manufacturers also produce at least one non-HFSS product, which can be used to maintain sales in primary store locations, whilst recipes are reformulated, or new products developed.

There is no time like the present and it’s important for brands to test, test, test way before the legislation kicks-in.

Several brands are already doing this and doing it well. If your product line is being threatened by the HFSS regulations, then you should look at what your competitors are doing to stay ahead and maintain your market share moving forward.

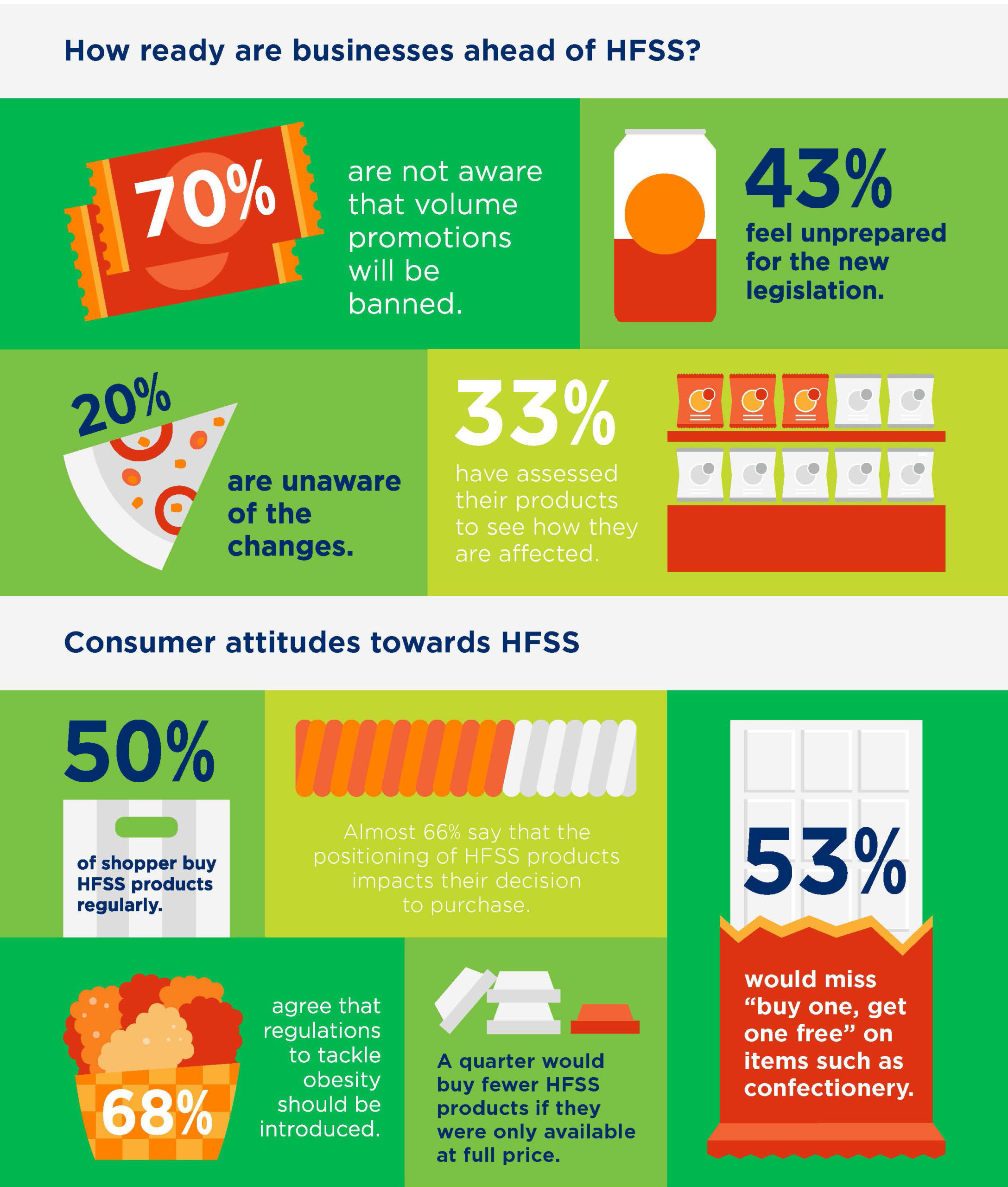

Research by GS1 UK has found that only one in three firms have assessed their products ahead of the October deadline, with just 48% reformulating existing products and around one quarter having not even considered it.

It also emerged that only 33% are training staff on the new rules and only 35% are auditing suppliers.

Two-thirds of businesses questioned said that more financial support from the government is needed to help them adapt – with 81% saying the new rules will significantly change how they operate.

The group has joined forces with the UK retail industry to launch a HFSS platform solution that helps you comply with high fat, sugar and salt (HFSS) data requirements, so you can focus on other areas of your business. Approximately 75% of grocery retailers in the UK are now using the product data sharing service, including Sainsbury’s, Tesco, Waitrose, Ocado, Asda, and Morrisons.

Who is already adapting to the HFSS regulations?

The product categories that will suffer the most when the new legislation is brought in are, crisps and other savoury snacks, biscuits, cereals and cereal bars, chocolate bars, confectionary, pizzas, and ready meals.

Here are some brands that have already started adapting their ranges, or shifting advertising spend to start building traction for their LFSS products.

Popular manufacturer of crisps, Tyrrells, are making the move into lentil crisps, like many of their competitors, to meet customer demand and tap into the better-for-you category.

Nurture Brands has relaunched one of its LFSS products, Emily Veg Thins, to help improve the brand’s overall HFSS score. Here they have reduced saturated fats and calories to improve their already ‘good’ HFSS credentials.

Samworth Brothers’ brand, Soreen, has not only reduced the amount of sugar in its chewy malt loaf bars, but has also invested more advertising budget to promote this ‘healthier’ alternative.

Graze, like Soreen, is pushing products that are low in fat, sugar, and calorific content, including its Super Snackers range aimed at children. At this stage it is unknown as to whether the full range of Graze snack pots will be reformulated, but adapting a few key items is sure to help the brand maintain some of the prime in-store locations they have obtained over the last few years.

Popular meal-deal snack option, PROPER Snacks, has always promoted its Proper Corn as being less than 100 calories per pack, and have now expanded their range to include Proper Chips to provide diversity for consumers already familiar with the brand.

Some flavours may need to be adapted to ensure low salt and sugar content, but it can be expected that the Proper Corn range will still maintain its position in-store.

The Skinny Food Co is expected to claim some of that prime shelf-space once the new legislation comes into effect. Like, Proper Corn, the full range of products is low in calorific content but may need some small tweaks to improve the HFSS score across the range. Brands like The Skinny Food Co are now in a great position to (re)negotiate terms with retailers who will also be looking to secure HFSS compliant brands for those key locations and promotional partners.

What about salt and sugar taxes around the world?

In recent years, similar HFSS legislation and taxes have been brought in around the world to tackle obesity rates and promote healthy living.

According to Kerry, 2016 was widely regarded as “the year of the sugar tax” due to widespread legislation spurred by a 2015 World Health Organization report. Governments around the world have since implemented several health-related taxes, with around 50 countries and jurisdictions currently enforcing certain measures or requesting recipe changes from manufacturers of HFSS products.

The table below has been lifted from Euromonitor’s 2020 report, “Global Sugar Confectionary: At a Crossroads of Health or Indulgence”. It illustrates a few examples from around the world.

Key changes being brought in tend to focus on the following areas:

You can find a full list of the taxes and/or regulations in place around the world here, published by WASSH (World Action on Salt, Sugar and Health).

Will there still be opportunities for LFSS products overseas?

Absolutely!

As you can see, there are over 50 countries around the world that have already implemented similar regulations to those due to come in to place in the UK next year.

If you’re a manufacturer of products that are going to be affected by the UK HFSS legislation, and you’re considering new product development or recipe reformulation, then take this opportunity to educate yourself on the requirements of the potential overseas markets you may not have been able to do business with previously.

Developing products with multiple markets in mind will put your brand in a great position for approaching international retailers and distributers.

This is where Bolst Global can help. We work with both domestic and international health and wellness brands to make connections around the world. We can also advise on potential markets where your products will do well and meet demand.

Ready to talk? Reach out to a member of the Bolst Global team today, we can’t wait to hear from you.