Saudi Arabia Soft Drink Market

With a growing population and evolving consumer preferences, the soft drinks market in the Kingdom and UAE is experiencing significant growth and transformation. In this blog post, we’ll delve into the key insights provided by both industry report and our own market research on the Saudi Arabia and UAE soft drinks market to understand the trends, challenges, and opportunities shaping this dynamic sector.

Market Overview: Saudi Arabia and the UAE soft drinks market is witnessing robust growth, driven by factors such as increasing disposable income, rapid urbanisation, and changing lifestyles. The market encompasses a wide range of beverages, including carbonated drinks, juices, energy drinks, and bottled water, catering to diverse consumer preferences.

The size of the UAE soft drinks market sits at 1.7 billion litres versus Saudi Arabia at almost 5 billion litres. Both have seen increasing sales by approx. 3% over the period between 2017 to 2022.

Saudi Arabia is the market to watch in the Arab e-comm market, expected to reach 8.2 Billion USD by the end of 2024. Although the UAE is currently the largest overall market size, Arab News reports the Kingdom is growing at a faster rate.

Key Insights for Saudi Arabia

Carbonated Drinks Dominate:

Carbonated Drinks Dominate: Carbonated drinks hold the largest share in the Saudi soft drinks market, fuelled by their popularity among consumers of all age groups. Brands like Coca-Cola, PepsiCo, and local players have established a strong presence in this segment, offering a variety of flavours and packaging options to cater to diverse tastes.

Health & Wellness Trends

Health & Wellness Trends

With rising health awareness among consumers, there is a growing demand for healthier beverage options such as natural juices, functional drinks, and low-sugar alternatives. This trend is driving innovation in product formulations and packaging strategies, with companies focusing on introducing healthier options to meet consumer preferences.

Exotic & Fruity Flavours

Exotic & Fruity Flavours

Fruit flavours, including tropical fruits, berries, and citrus infusions held over 37% of the market share. Consumers are increasingly drawn to beverages that offer novelty and excitement, seeking out new sensory experiences in their soft drink choices.

Shift Towards Convenience

Shift Towards Convenience

Convenience is a key factor influencing consumer purchasing decisions in Saudi Arabia’s soft drinks market. Ready-to-drink (RTD) formats, on-the-go packaging, and availability through various retail channels including supermarkets, convenience stores, and online platforms are driving the growth of the market.

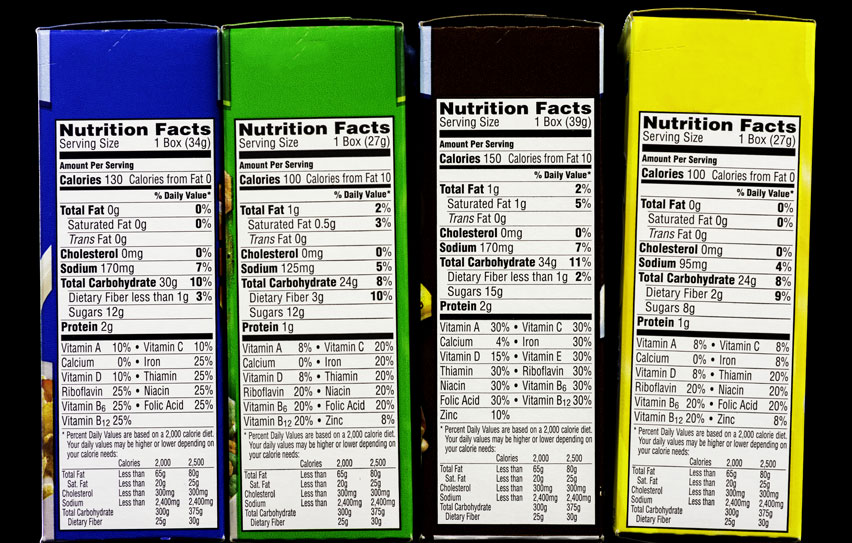

Regulatory Landscape

The Saudi government’s initiatives to promote healthy lifestyles and regulate the beverage industry are shaping the market dynamics. Stringent regulations on sugar content, labelling requirements, and advertising restrictions are influencing the product portfolios and marketing strategies of soft drink companies operating in the Kingdom. Any drinks with a sugar content (natural or artificial) has a 50% increase on the shelf retail price that is payable to the Saudi government.

Target Audience

Target Audience

The adult segment held over 46% revenue share in 2022 and will continue to dominate. This can be attributed to the Vision 2030 initiative whereby the Ministry of Education has banned soft drinks in schools, as well as, the growing population of adults in their 20s – 30s and their increased disposable income and changing lifestyle.

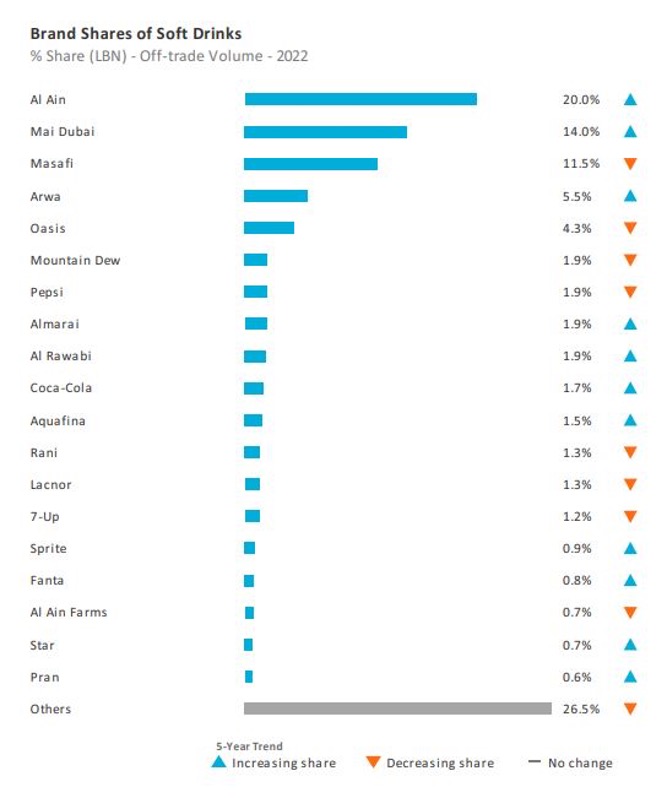

Key Insights for the UAE Soft Drinks Market

Key Insights for the UAE Soft Drinks Market

Functional drinks (those that relieve stress, promote sleep, improve energy, boost immunity) hold the largest share in the UAE drinks market, with over 1.6 million litres in off-trade volume in 2022.

Rising Popularity of Smaller Bottles and Canned Formats

In the UAE, there is a notable increase in sales of smaller bottles and canned formats, particularly through the Aquafina brand. This trend diverges from other markets where canned formats may not be as popular. This relates to it’s ability to offer more convenience as they’re easier to store, carry and consume on the go. Also, smaller bottles and cans provide consumers with better control over portion sizes, which is becoming increasingly important as people become more health conscious.

Predicted Regrowth of Sparkling Flavoured Water

Sparkling flavoured water is expected to regain lost growth momentum in the UAE soft drinks market in the foreseeable future.

Regulatory Landscape

Just like the in the Kingdom, the UAE government have some regulations that can pose a significant challenge in the UAE soft drinks market. The excise tax means that any drinks with a sugar content (natural or artificial) has a 50% increase on the shelf retail price that is payable to the UAE government. Not only this, but bottled water is subject to an additional regulatory requirement beyond standard registration. ESMA/EQM certification is necessary, adding to the regulatory landscape for soft drink companies.

Growth Predictions in Sports Drinks and RTD Coffee and Tea

Again, similar to Saudi Arabia, the UAE soft drinks market anticipates growth in ready-to-drink (RTD) products in the upcoming period. These include coffee and tea and sports drinks.

Opportunities For Growth

Opportunities For Growth

Despite challenges such as increasing health concerns and regulatory pressures, the Saudi Arabia soft drinks market presents promising opportunities for industry players. Key areas of growth include:

Conclusion

Conclusion

The Saudi Arabia and UAE soft drinks market is undergoing a period of dynamic change, driven by shifting consumer preferences, regulatory interventions, and technological advancements. By staying abreast of these trends and seizing emerging opportunities, companies can position themselves for success in this thriving market

Sources:

Source: Astute Analytic, Bolst Global

If you would like to find out more about how your soft drink could successfully navigate the high growth opportunity of Saudi Arabia book a consultation with our Founder Victoria to discuss your product and our suites of support services that could accelerate your market entry into this territory!

To do so fill in your details via the contact form below and state your consultation request