Qatar food and drink trends 2021

More export opportunities in the Middle East

Qatar is a small slice of (tax) heaven in the Gulf that, like Kuwait, is often overlooked by exporters looking to enter the Middle East.

In our latest market spotlight, we’ll introduce you to the food and beverage landscape of Qatar, the best routes to market, and the health and wellness trends we anticipate being the next big thing for Qatari consumers.

Demographics

Located in Western Asia, Qatar shares a border with fellow Gulf Cooperation Council (GCC) member, Saudi Arabia, whilst the Gulf of Bahrain separates Qatar from its second closest neighbour.

With a total population of 2.9 million, Qatar is considerably smaller than surrounding Gulf territories. That being said, 88% of the population are expatriates who outnumber Qatari citizens by almost nine to one.

Women make up only 25% of the population due to the huge number of male labourers who migrate to Qatar for employment opportunities.

The median age of Qatari residents is 33.2 years of age, with a life expectancy of 78.9 years.

Thanks to the country’s solid industry and trade in oil and gas, the International Monetary Fund estimates that Qatar’s GDP (PPP) per Capita will reach 97,262 USD in 2021, ranking it fourth highest in the world.

Food and beverage landscape

According to a report published by Alpen Capital, annual food consumption in Qatar is expected to grow to 1.9 million tonnes by 2023, aided by high disposable incomes, a growing expat population, and young, urbanised consumers.

The average monthly household income in Qatar is 5,584.06 USD, thanks to the lack of income tax, and around 20% of that is spent on groceries per household.

During the 2017 diplomatic crisis, a blockade was put in place that limited Qatar’s access to air space, sea routes and land crossings, preventing both incoming and outgoing trade, including food and beverage.

Around 90% of Qatar’s food is imported and prior to the blockade, 27.4% came directly from Saudi Arabia and the UAE, whilst 80% of imported goods passed through a bordering country.

Data from 2018 valued food and beverage imports at around 3.3 billion USD (12 billion Qatari Riyals), decreasing to 2.9 billion USD in 2019.

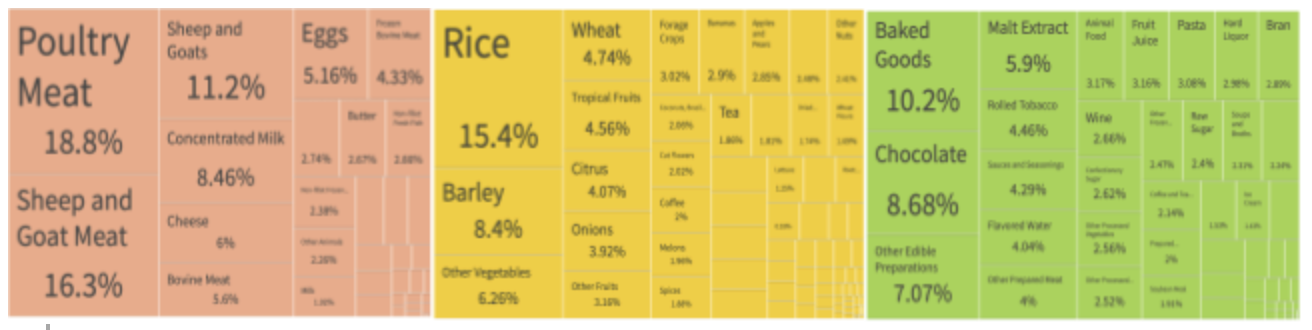

The figures below illustrate the percentage of the total 2019 import value split across several food and beverage categories.

The good news is that political relationships across the GCC region are improving daily, which has lifted barriers to international trade allowing goods to start moving smoothly back into Qatar.

What’s interesting about this situation is how Qatar strategically handled the blockade to ensure long-term food security through promoting local production.

Despite Qatar’s warm climate, which results in adverse farming conditions, some of the most profitable locally produced goods include date palm, vegetables, cereals, fruits, meat, fish, and dairy products.

Thanks to the Qatar National Food Security Programme, the Qatari government is committed to boost domestic food production and agriculture to create and promote self-sufficiency throughout the country.

Through Hassad Food, a wholly owned subsidiary of Qatar Investment, Qatar has also purchased arable land in Sudan, Australia, Kenya, Brazil, Vietnam and the Philippines in order to diversify the range of food produce and ingredients needed to reach the government’s 2030 self-sufficiency milestone.

Routes to market

Qatar continues to import international food and beverage products which are unable to be produced locally. This is incredibly important when it comes to meeting the needs and demands of expatriate consumers and tourists in the region.

Food consumption in Qatar is heavily dependent on the influx of tourists visiting the country. Food service outlets and hospitality still act as a great route to market for international brands.

With the 2022 FIFA World Cup taking place in Qatar, millions of tourists will need to be fed and watered during the 28-day event. This presents a fantastic opportunity for manufacturers to enter the region for the very first time. More on that later.

In addition to the food service sector, brands can also approach local retailers to get their share of shelf space. In 2017, Alpen Capital reported that the food retail sector in Qatar was “underdeveloped” when compared to the rest of the GCC.

At the time it was publicised that this sector would experience rapid growth with a compound annual growth rate (CAGR) of 4.4% expected between 2016 and 2021, representing the third highest growth in the region.

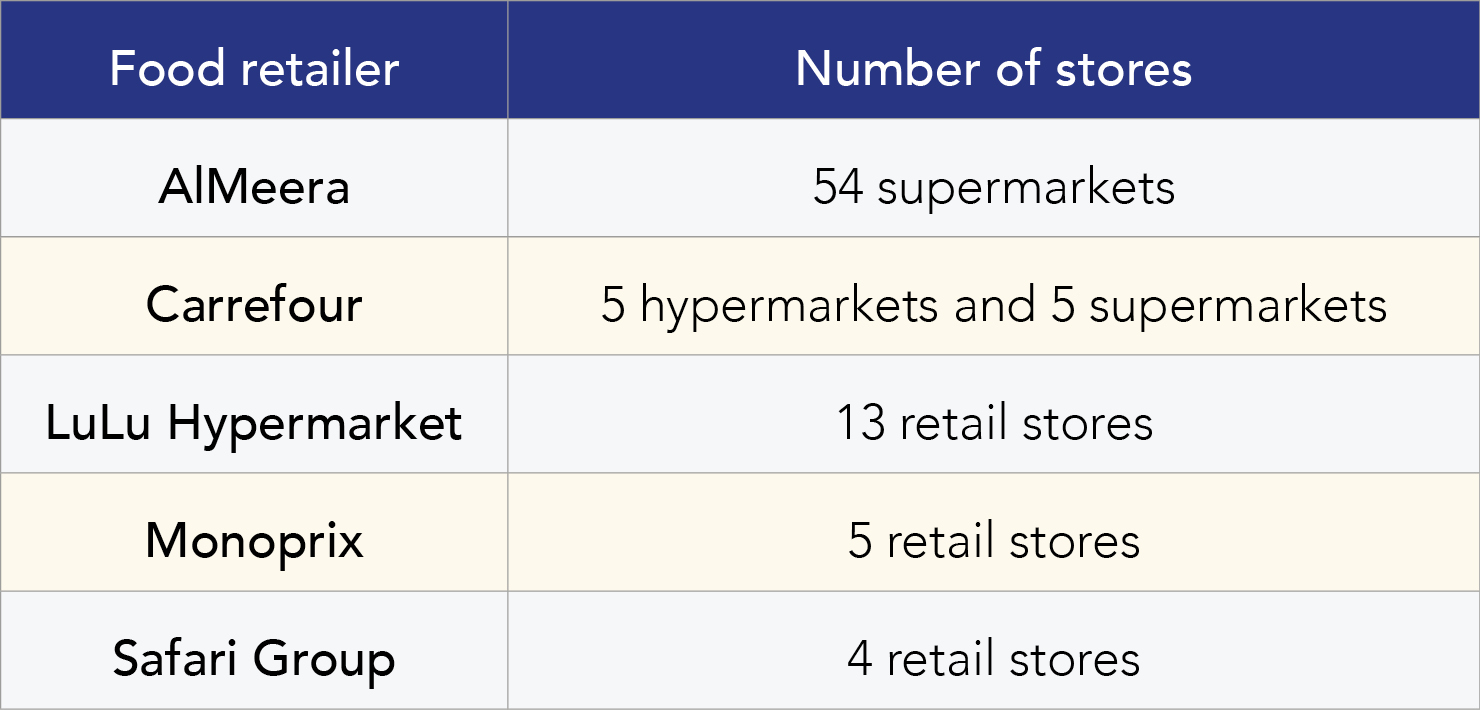

The table below highlights the five most popular food retailers in Qatar.

Other retailers with 8 stores each Include MegaMart and Rawabi Hyper Market.

It is worth noting that there are 11 Boots outlets and 2 Holland and Barrett stores In Qatar too, working off franchise models.

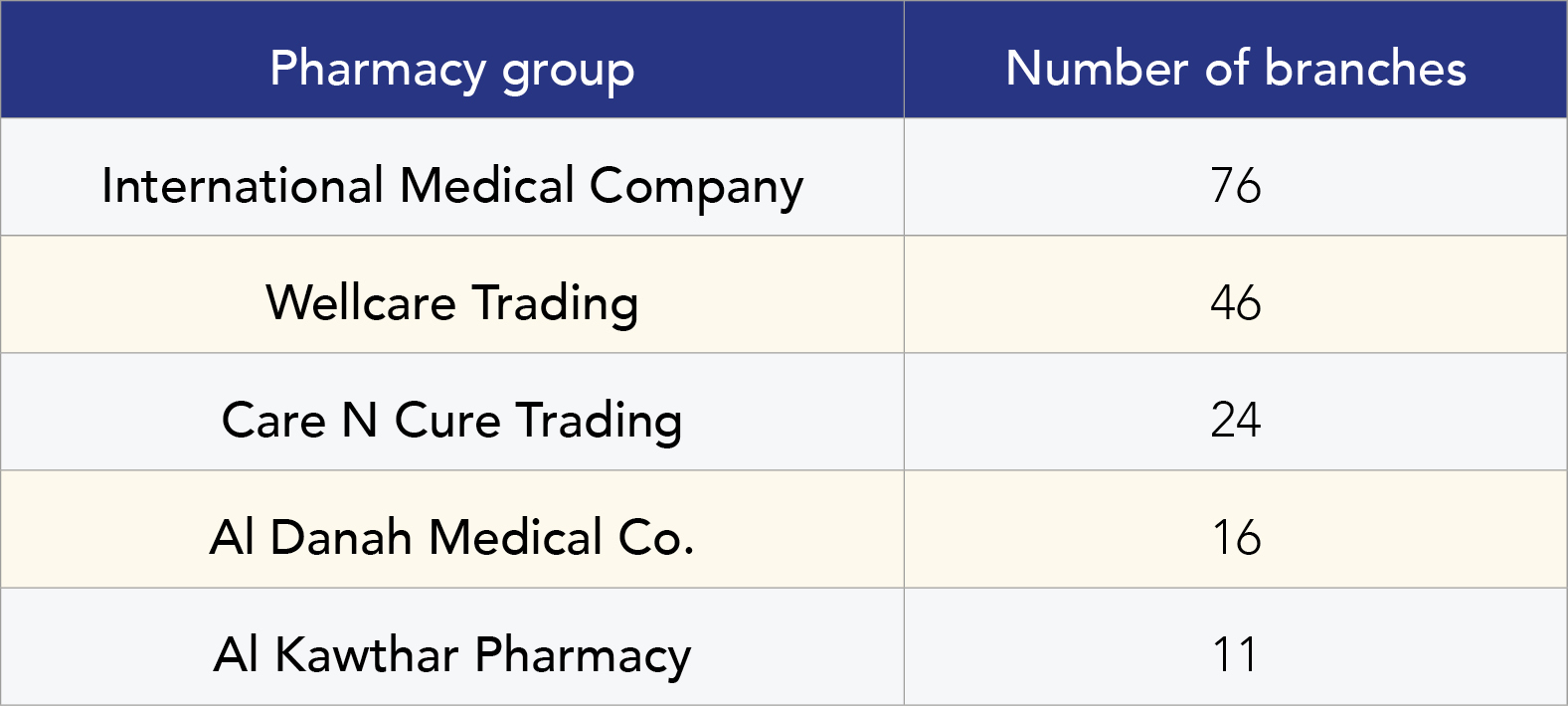

In addition to supermarkets and other retail outlets, health foods and supplements are often distributed and sold across Qatar via pharmacies and hospital clinics.

This is one route to market that should definitely be considered as in some parts of the country, consumers have better direct access to a pharmacy than a supermarket. Moreover the more accepted route to market for supplements can generally be via pharmacies and hospitals as opposed to grocery retail. The following table highlights the pharmacy groups with the highest number of branches across Qatar.

Health and Wellness trends in Qatar

Like neighbouring GCC countries, the Qatari Ministry of Public Health launched an initiative to reduce consumers’ intake of fat, sugar and salt by limiting the usage of particular ingredients in both imported and locally sourced goods.

Other government schemes to improve health and wellness across the country include introducing taxes on unhealthy food and beverages like alcohol and energy drinks.

In this section we’ll explore three trends that are set to take the health and wellness, food and beverage sector of Qatar by storm. If you’re considering Qatar as a target market for your brand, then be sure to take note as there are some great opportunities on the horizon for international brands.

Post-covid consumer habits

A 2020 study published in the Sustainability journal, investigated the “immediate impacts of COVID-19 on Qatari consumer awareness, attitudes, and behaviours related to food consumption” resulting in “clear changes in the way consumers are eating, shopping, and interacting with food.”

Amongst a really interesting collection of results, is the clear shift in consumer attitudes towards healthy eating. Here are some of the stats.

Similar trends have been seen elsewhere around the globe, so health food brands looking to enter the Middle East could really benefit from the change in behaviours in Qatar, where their products are now in demand.

International brands with a focus on health and wellness will thrive in the post-Covid world, and Qatar is no exception.

The rise of organic products

In conjunction with the changing consumer attitudes, and a shift towards living a healthier lifestyle, organic products are increasing in popularity throughout Qatar, presenting a great opportunity for international brands to enter the market.

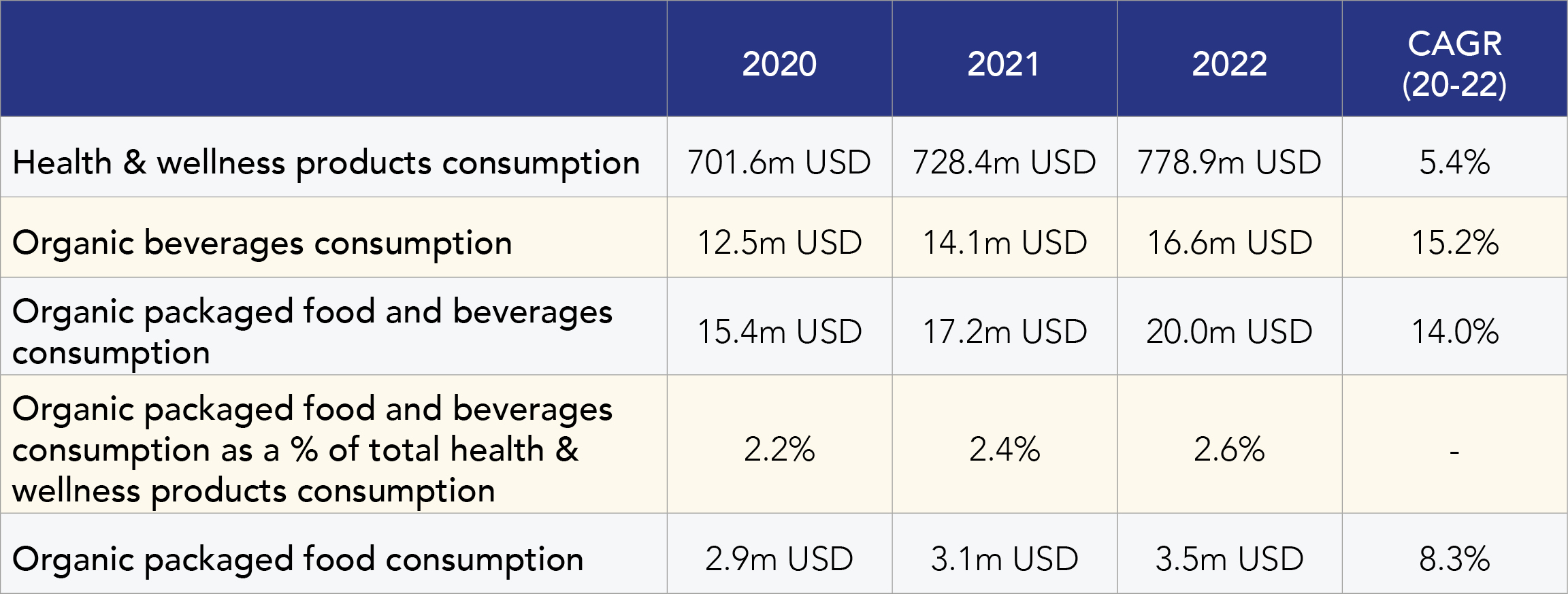

The table below illustrates data taken from the Global Organic Trade Guide. It focuses on organic food and beverage consumption in Qatar. Additional data can be found here.

Specialty organic food suppliers, retailers and brands such as Organic Land, Spinneys, and Raw ME continue to drive demand for fresh, local, organic produce across the region.

Right now, Qatar’s most popular organic product categories are savoury snacks, grab-and-go fruit, seed and nut bars, and kitchen staples such as oils, flours, tinned goods, and preserves. Baked in Brooklyn, Taste of Nature, and Biona Organic are all imported and sold in Qatar, and are some of the most sought-after organic brands in the country.

Alcohol-free beverages

With Muslims making up 67.7% of Qatar’s population, alcohol consumption in the country is relatively low.

In fact, like much of the neighbouring GCC countries, most alcohol consumption is by tourists, limited to food service outlets and hospitality, but with the 2022 World Cup coming up it’s something which could threaten the success of the competition.

It is forbidden to drink alcohol in the stadiums during the event meaning that fans cannot enjoy an alcoholic beverage before, during or after a match.

This ban could have led to FIFA having to have an awkward conversation with loyal sponsor Budweiser, who have been donating beer to the competition since 1986, however it’s likely that Budweiser will get around the ban through the sale of their alcohol-free beer.

On a positive note, the prohibition presents opportunities for other producers of alcohol-free beverages to enter Qatar. Over the last two years or so, there has been a rise in the demand for low or alcohol-free drinks in the West. With the World Cup coming up, there is no better time to look to Qatar as the next big export market.

Sources:

- https://www.imf.org/en/Home

- https://m.gulf-times.com/story/654046/Qatar-s-food-consumption-forecast-to-grow-to-1-9mn-tonnes-in-2023

- https://www.statista.com/statistics/731884/qatar-food-and-beverage-import-value/

- https://oec.world/en/profile/country/qat

- https://dohafamily.com/living_in_doha/where-does-our-food-come-from-an-insight-into-qatars-food-industry/

- https://oxfordbusinessgroup.com/analysis/hyper-activity-supermarket-chains-rush-meet-demand-affluent-customers

- https://www.mdpi.com/2071-1050/12/9/3643

- https://www.mdpi.com/2071-1050/12/17/6973

- https://globalorganictrade.com/country/qatar

- https://en.wikipedia.org/wiki/Religion_in_Qatar

- https://www.worldcup2022football.co.uk/sponsors