Food and drink export rules after Brexit

2020 will go down as an unforgettable year for many of us.

For some there has been overwhelming business success and record breaking profits tied into long working hours and an ongoing struggle to keep up with demand, this is especially the case for health and immunity related food, drink and supplement producers servicing the retail sectors.

For others the grind to a standstill of food service and HORECA channels in many global markets has meant catastrophic problems, with some businesses unfortunately having to close their doors forever when it hasn’t been possible to transform their businesses into something where sales can still occur.

On top of that for European manufacturers and customers we have Brexit…creating even more uncertainty for those companies with existing and/or future ambitions to trade between Britain and the European Union (EU). Let’s not forget that this will impact significantly not just those British suppliers selling products into the EU but also those European suppliers who have British customers too.

Our team have been helping our clients over the past few months to navigate the changes they will need to put into place from 1st January 2021 in order to be able to continue supplying the EU. Although we are now just a matter of days away with STILL no definitive decisions made nor trade deal in place, there are still a number of ways in which you can prepare your company as best as possible.

The following tips are for food brands and manufacturers who supply products to the EU that do not contain ingredients of animal origin. You will also find a number of useful links at the bottom of this article for additional support too.

Top Five Tips to get Brexit Ready

1/ Get an Economic Operator Registration and Identification (EORI) number

You can request one through the gov.uk website here.

2/ Brexit commodity codes

For companies who have only traded within the EU before then you won’t have needed to provide these. But on a global basis the use of commodity codes is very important when it comes to the tariffs and duties that are payable on products as they move from one territory to another, especially with Great Britain becoming a third country in the eyes of the EU.

Get the code wrong and you could encounter delays with products being held at the point of entry or your customers importing the goods paying more than they should in duties.

For Great British producers you can check what is your commodity code here.

For those businesses importing goods (finished or raw materials) into the UK then with your commodity code you are find out any differences that will apply in tariffs from 1st January 2021 by using the UK global tariff tool that you can access here.

3/ Brexit certificate requirements

Again like commodity codes, buying and selling goods within the EU didn’t previously require certificates like trading outside the single market does.

This will change from 1st January 2021 although the precise guidance on whether your products are going to need documents such as phytosanitary certificates for plant products, and Health Certificates or EU/UK certificates of origin is still unclear.

You can find out about Certificates of Origin that are processed from the local Chambers of Commerce here and how this will change from 1st January 2021 here.

You should consider the impact in processes as well as cost that having to undertake these certification requirements with make to any existing or future trade you wish to have between Great Britain and the EU.

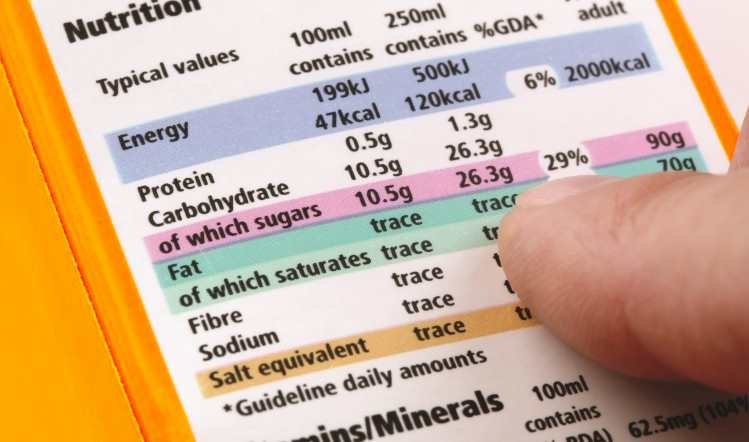

4/ Brexit Food Labelling Rules

The main sticking point for many of the Great British producers has been the need for the Food Business Operator (FBO), in other words the manufacturer, to have an EU registered address on their food label / pre packaged goods from 1ST January 2021.

This cannot be a serviced office nor a PO box number and must be a physical address and a presence which can be inspected.

For those food suppliers who do not have another office, branch or production in the EU then this is highly problematic as it is creating more cost and complication in order to maintain their EU trade. This is especially the case with those companies who are not physically taking products out of the country and are either selling onto other UK companies who are then dispatching goods into the EU or are delivering to another British destination and then their overseas customers are collecting and taking ownership of the goods from that point.

So what is the solution?

More guidance on this can be found here.

Other major issues from a food and drink labelling point of view have been in relation to the country of origin whereby from 1st January 2021 if you don’t already do so then Great British producers should state ‘Made in the UK’ and not EU.

When it comes to the use of the EU Organic logo then this also should cease from 1st January 2021 and the SOIL Association gives up to date information on the necessary changes required for Great British producers as details become clearer.

5/ Post Brexit Customs Declarations

Regardless of whether a trade deal with the EU is struck in the final few days of 2020, one thing is clear: customs declarations of goods coming in and out of Great Britain into the EU is going to be a mandatory requirement.

As such there needs to be an official exporter and importer to account for this trade and to fill out the necessary documentation.

For those businesses already trading outside of the EU then you will be more accustomed to doing this and working with freight forwarders and custom brokers.

You should speak with your current customers in the EU and make sure they are in a position to act as the importers and fill out the necessary new declarations either themselves (if they are equipped to do so) or via the freight forwarders they use.

If you are an EU producer selling into Great Britain then you should likewise speak with your customers based there to make sure they are aware of their need to be officially importing products and have the capability to undertake import declarations themselves or via the freight forwarder company they or you work with.

Useful links and support for the trading of goods between the EU and Great Britain post 1st January 2021:

The latest information on organic labelling by the Soil Association for Great British companies https://www.soilassociation.org/certification/preparing-your-organic-business-for-brexit/

https://euexitfoodhub.co.uk/export/

https://www.britishchambers.org.uk/page/brexit/business-brexit-checklist/cross-border-trade