This short guide is an introduction for new exporters on some of the fundamentals related to exporting your food and drink products overseas. It will give you some key areas to consider along with some useful places to expand your knowledge relative to your products and business.

In terms of choosing to grow your business into new markets with the current events of 2020 and the ensuing uncertainty in many parts of the world this is an opportune time to do so. Those companies who can retain and expand their customer base around the world profitably put themselves into the best possible position for the future.

There are many benefits to exporting including:

34%

increased business productivity*

11%

more likely to survive a recession

18%

more innovative than those who only trade domestically*

It is therefore clear that exporting can be advantageous to your business. However, this is provided you are smart about how you approach internationalisation and comprehend what your obligations as an exporter are from the outset!

By understanding the various elements of exporting you need to appreciate and implement, your export development will be a success. Not only for you but also for your delighted customers around the world.

Here’s a whistle stop tour of the most important aspects to take into consideration.

1/ Which country to target?

There are over 190 countries in the world. You can’t target them all at once, so which one(s) to choose?

Where possible, go for the one which offers the greatest potential returns for the least effort. There is plenty of time to work your way up to the difficult ones! This could be countries which are either culturally or geographically close to you. Or If you have already received unsolicited enquiries, that is a great place to start too, albeit you need to vet the interest carefully. Also, check your google analytics to see where your website traffic is coming from.

That can also be another good indicator of where potential demand could be. There are many ways to decide which market(s) are the most opportune for you and it is important you know the basis on which and why you are targeting certain market(s).

2/ Does your product need any modifications?

You LOVE your product as it is, so why wouldn’t everyone else? Hopefully they will but check first if there are any market specific requirements around ingredients, shelf life restrictions, necessary certification, packaging requirements that may be necessary and which you therefore have to change about your product.

If you do need to make any changes to your product for the market then you also need to consider how far you, as a business, are able and willing to go to do this. This is an important decision to make and each company is different in their approach to product and new market adaptation.

Decide what is right for you and stick to this!

3/ What documentation do you need to provide to get your goods into the destination country?

You would think your overseas buyer would be able to tell you exactly what is needed to get your goods through their Customs Authority…well collectively we have been exporting for over forty years and can count on the fingers of one hand those customers who truly could.

So, before you even send out an order acknowledgement, by all means take their advice but also research independently what will be needed for you to provide from an export documentation perspective. A great place to start is the Tates Export Guide: www.just-trade.co.uk

In addition, this video provides an overview of the general export documentation you may need FAQ: What export documentation do I need.

4/ Payment terms

An important base to cover. Never was there a truer saying than ‘a sale isn’t a sale until you’ve been paid’.

Explore the different types of payment terms you can offer your overseas customer from payment in advance to an Irrevocable Letter of Credit.

If you can then avoid credit terms for the first few orders until you have had chance to build up a degree of trust with the overseas buyer. In many ways this is no different to what you would do for a domestic sale and new customer.

Of course, some customers can be quite demanding, especially the larger players in the market. You can only land the sale if you offer credit terms? Then make sure you get some robust credit insurance in place to cover you in case of any non-payment from your customer.

5/ Delivery terms

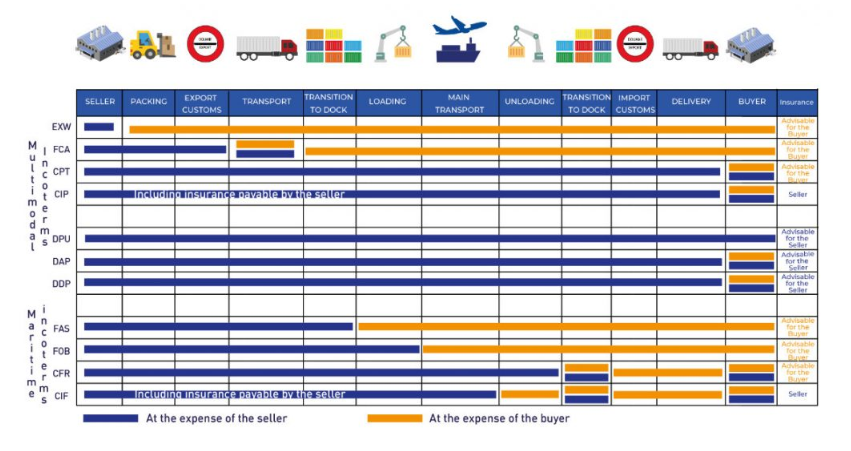

You may already have heard of Incoterms? You may know and love Incoterms 2020. If you don’t, take a look at them. Incoterms are internationally recognised delivery terms covering the journey from seller to buyer.

They define whether the buyer or the seller carries out particular tasks or picks up particular costs and also define where risk and responsibility for the goods pass from the seller to the buyer. Incoterms can seem complex but don’t miss this element out when both calculating prices and negotiating the sale. Making errors here can cost you dearly, as we have seen happen to companies on several occasions.

For more guidance on Incoterms and the differences to be aware of in your seller obligations then check out this useful link: https://www.tradefinanceglobal.com/freight-forwarding/incoterms/

6/ Duties and sales tax

Most overseas countries will charge an import duty and sales tax on your goods when they arrive at the destination – usually paid by your customer so you don’t need to factor this into your commercials offered. However, be mindful that your customer will when calculating their landed costs and potential profit margins they can achieve.

The rate of duty charged will depend on the H S Tariff code for your product – which you will need to determine and show on the invoice which accompanies your goods.

Visit the UK Trade Tariff to establish your code if you don’t already know it: https://www.trade-tariff.service.gov.uk/sections

7/ How to physically get your goods there?

Dependent on cost, transit time and availability of service, there are a number of ways to deliver your goods: air, sea, rail, post, courier. For regular small shipments it is worth setting up an account with one of the larger worldwide couriers as doing so lowers the overall cost per shipment rather than sending parcels ad hoc.

For larger shipments going by air or sea then this is where a good freight forwarder comes in. Interview a few, make sure they have a direct service to the country, avoid those that sub-contract more than a couple of times – it can add days onto the transit time.

8/ Compliance issues

There. We said it: compliance. We admit it, this is a dry but unfortunately necessary aspect of exporting to cover off. First of all, you need to get your product label compliant with the export market you are selling into.

Next consider the compliance paperwork: does your product need a health certificate? Does it need a Certificate of Origin? Can you supply the customer with a Preferential Certificate of Origin so they can pay less or even no duty when it arrives? Is your product or packaging considered hazardous in any way for transit?

Sorry but there is no getting away from having to do your due diligence here. It is time consuming, it’s not sexy but do it at the outset and you’ll avoid countless hours of problems in the longer run.

9/ Back office systems and procedures

Avoid recreating the wheel each time you send an export shipment.

Sort out your back-office systems so that as many of the elements mentioned above are automated. Have an account set up with your designated Chamber of Commerce to be able to process export documents quickly. Create templates for your Commercial Invoices, Packing List etc within your systems so they can be easily adapted for future orders.

You will thank us for it in the long run.

10/ Training

Often seen by businesses as a discretionary on-cost, but don’t skimp on this.

Knowledgeable staff will save you thousands of pounds and shave days off delays caused by lack of training. Give your export staff the confidence to do a great job for you by upskilling them – then watch your exports fly.

This guide was co-written by Jayne Mezulis and Victoria Boldison. Jayne is an export professional who specialises in export documentation and compliance. Victoria specialises in export strategy, marketing and business development.

For more information or export support, please complete the contact form below and one of our team will come back to you.