Australian Retail Market

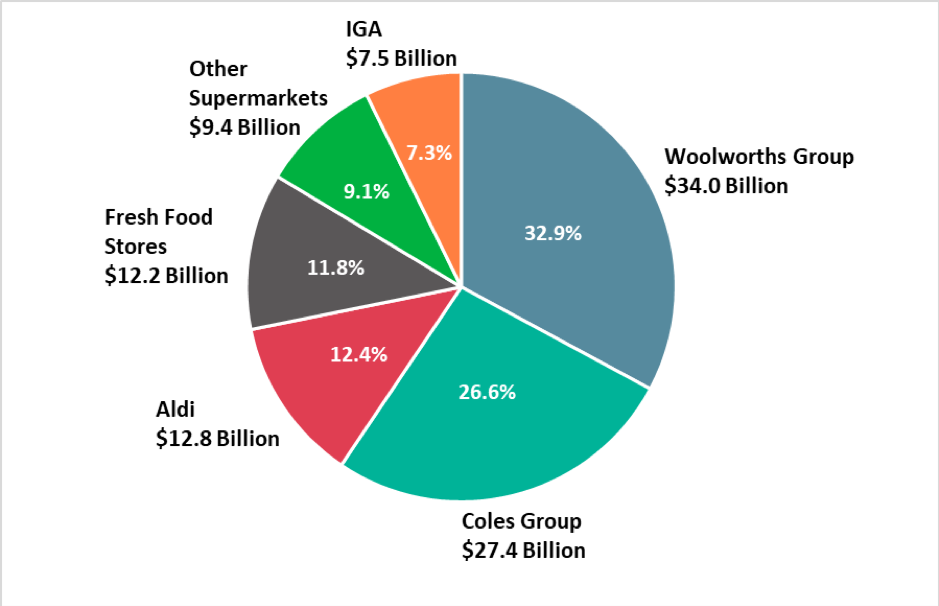

The Australian retail sector is dominated by 4 main retailers; Woolworths, Coles, Aldi and Metcash. Metcash is the country’s largest grocery wholesaler and its retail brands include IGA, Supa IGA (supermarkets), and IGA Express (convenience stores). The industry had been gearing up for the entrance of German discounter, Kaufland, but their recent surprise exit from the Australian market has taken some pressure off regarding price wars but retailers are still faced with the challenge of intense competition, increasing costs, emerging global competition, brand repositioning and an ever-changing shopper.

In 2019, Woolworths Group and Coles Group both declined in market share, while Aldi and other smaller chains increased. Aldi not only increased its market share of all supermarket spending, it also recorded strong growth in customer penetration.

Source: Roy Morgan Single Source Australia, January 2019 – December 2019, n = 11,045. Base: Australian grocery buyers aged 14+ (weighted to Australian households).

It is worth noting that Aldi has increased its market share from 6.7% in 2011, to 12.4% at present. While it’s still a fair way behind Australia’s two supermarket giants, to put this growth in perspective, Aldi is now approaching half of the market share held by Coles Group.

The Independent sector is also significant with the Metcash supported IGA retail banner as well as strong regional players such as Drakes (South Australia and Queensland) and Harris Farm Markets (New South Wales).

Department store David Jones has also been revamping its premium foodhalls and has started to roll out standalone foodstores as well as launching a partnership with BP to sell a range of 350 premium packaged and convenience foods at selected BP fuel outlets.

Online Sales

Both Coles and Woolworths have reported massive growth in their online sales. Coles reported 30% sales growth in Coles Online, generating $1.1 billion in sales, and achieving profitability for the first time in 2019. Similarly, Woolworths reported over the same time $2.53 billion in online sales and 31.6% growth however, there is still progress to be made and logistical challenges remain. Both have attempted to implement tactics to overcome these barriers by teaming up with third-party providers such as Drive Yello and Uber, to get deliveries to shoppers quickly, or in the case of Coles outsourcing fulfilment to Ocado.

Health, wellness and the environment continue to be major focuses among Australian consumers and as a result the healthy eating and free from categories are booming as is sports nutrition. Traditional snack categories such as confectionery, sweet biscuits and snack bars are seeing modest growth, with consumers instead embracing other packaged foods as a healthy on-the-go snack.

In line with increasing concerns about health and wellness, consumers are seeking better quality and healthier ingredients in their packaged food and drink products. They are also adopting “flexitarian” lifestyles where they are consciously choosing to have less meat in their diets and are seeking alternative sources of protein. Changing lifestyle trends and a steady rise in average incomes in Australia have also driven demand for fish and seafood, offering a premium alternative to meat as a rich protein source. This said, convenience continues to be a main driver for many consumers leading them to look to packaged food. This has constrained growth of fresh food especially as consumers looking for meat alternatives are buying meat substitutes, tracked under packaged food.

Consumers are also increasingly supporting products and brands that address concerns for better environmental outcomes. Food producers and retailers have made considerable investments into sustainability platforms as well as improvements in waste reduction and more transparency of the integrity of food production systems.

Trends

The rise of private-label products has allowed Australians to enjoy luxury products, such as gourmet foods and deli items, without paying significantly more. At the same time, real household disposable income and population are both expected to continue increasing, providing opportunities for growth.

Consumers born overseas are also driving retail growth. Australia’s high immigration rate means that retailers are having to constantly review ranges to meet consumer demand for specific demographics. Also, an aging population offers huge potential for FMCG marketeers.

Opportunities

Considerations and Doing Business in Australia

Australia is a significant producer of a wide variety of agricultural products and buying local is on the rise. There is a real focus on “Made/Grown in Australia” labelling and marketing so there therefore needs to be a strong unique selling points for imported products. Portion sizes are increasingly important too as consumers want quality over quantity and they expect packaging to be informative and environmentally responsible. There is also the need to offer innovative food products to break into what is a highly competitive retail food sector as most categories already have substantial market leaders.

Logistics and distribution are key factors due to the enormity of the country. The climatic and industrial environment varies as do market conditions, particularly between States. A good partner with national coverage is therefore vital in order to maximise sales. Many Australian companies are now attempting to provide a nationwide distribution network, either with interstate warehousing and distribution or by alliance with other distributors. There are also strict quarantine regulations with regard to fresh produce, meat and dairy products so it is key for all parties to understand the relevant procedures and requirements.

The commercial environment in Australia is regarded as exceptionally friendly and an attractive place to do business. Australians are open to giving new products and ideas a try. Apart from a very strict quarantine regime it offers few barriers to entry, a familiar legal and corporate framework as well as a sophisticated yet straightforward business culture. Exporting to Australia can also be a gateway to other markets in the Asia-Pacific region due to close trading links and free trade agreements.

This article was written by Jayne Hunt, our Bolst Global Associate based in Australia.

If you would like further information or advice on exporting to Australia then please complete the contact form below.